Gold closes out 2023 above $2063, technicals point to price gains in January

The Leading News Source in Precious Metals

Kitco NEWS has a diverse team of journalists reporting on the economy, stock markets, commodities, cryptocurrencies, mining and metals with accuracy and objectivity. Our goal is to help people make informed market decisions through in-depth reporting, daily market roundups, interviews with prominent industry figures, comprehensive coverage (often exclusive) of important industry events and analyses of market-affecting developments.

Gold closes out 2023 above $2063, technicals point to price gains in January teaser image

(Kitco News) – If you told investors in September of last year that by the end of 2023, the gold price would be closing higher than the year, many would have dismissed it out of hand. At the time, gold was trading in the $1,640 range, well off its highs following the Russian invasion of Ukraine, and high interest rates were providing additional headwinds for the precious metal.

Well, interest rates rose even higher this year, but spot gold still managed to finish the final trading day of 2023 trading at $2,063.45 at the time of writing, with many analysts predicting hundreds more in gains during the year to come.

Veteran trader CEO Technician noted in a post on X that gold had a solid year.

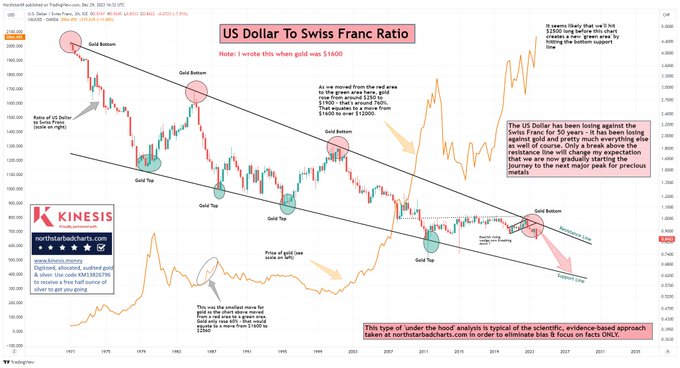

Kevin Wadsworth of NorthStarCharts hearkened back to those September 2022 doldrums to reflect on how far the precious metal has come, and why he was so confident in his bullish predictions.

pic

In another post, he shared an annual chart showing gold breaking to the upside ahead of 2024. “This will be gold's highest yearly close EVER,” he wrote.

And all of this comes ahead of what should be a very strong start to the new year, if history is any indication.

According to analysis by the World Gold Council, gold tends to perform very well in the first month of the year, posting an average return of 1.79% in January since 1971, nearly three times the precious metal’s long-term monthly average.

“This doesn’t mean that gold prices rise every January,” the WGC said. “There’ve been several years when it hasn’t, most recently in 2021 and 2022. Years with negative returns in January generally coincided with periods when the US dollar has strengthened – often significantly.”

But with the greenback seeing a recent pullback, and with rate cuts and treasury yields set to fall in the new year, January is shaping up to be one of the strong ones.

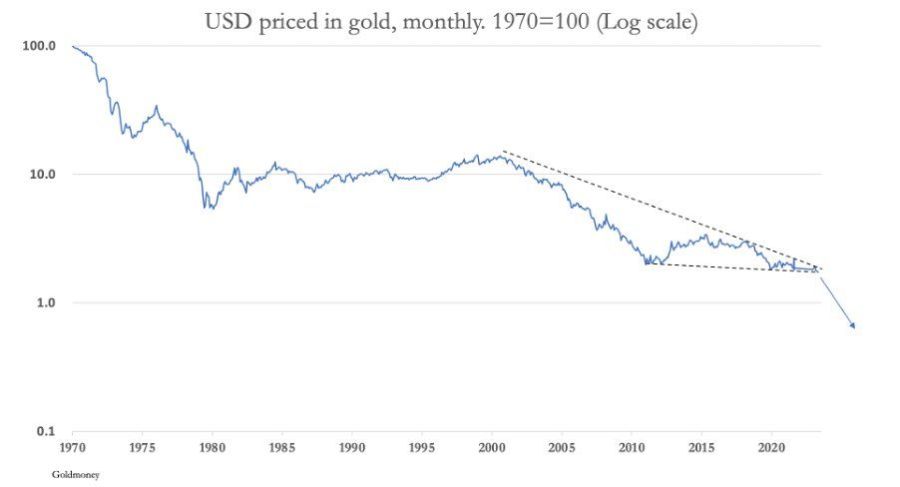

Alastair MacLeod, Head of Research for Goldmoney and SchiffGold, shared the following chart summarizing his perspective on gold’s likely trajectory in 2024. “It puts the price relationship in the right perspective!” he said.

Kitco Media

Ernest Hoffman

David