Analysts abandon bear cave for bull run, retail traders stay balanced but bullish

Kitco NEWS has a diverse team of journalists reporting on the economy, stock markets, commodities, cryptocurrencies, mining and metals with accuracy and objectivity. Our goal is to help people make informed market decisions through in-depth reporting, daily market roundups, interviews with prominent industry figures, comprehensive coverage (often exclusive) of important industry events and analyses of market-affecting developments.

pic

Analysts abandon bear cave for bull run, retail traders stay balanced but bullish teaser image

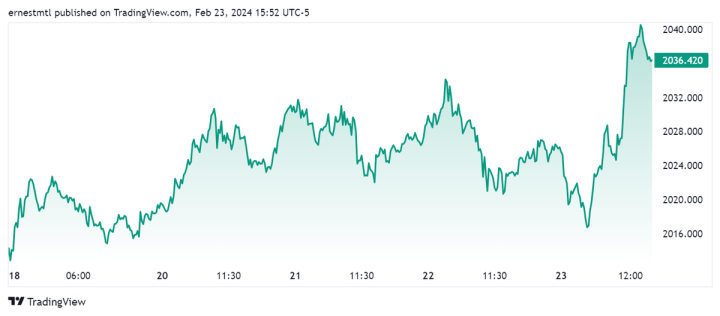

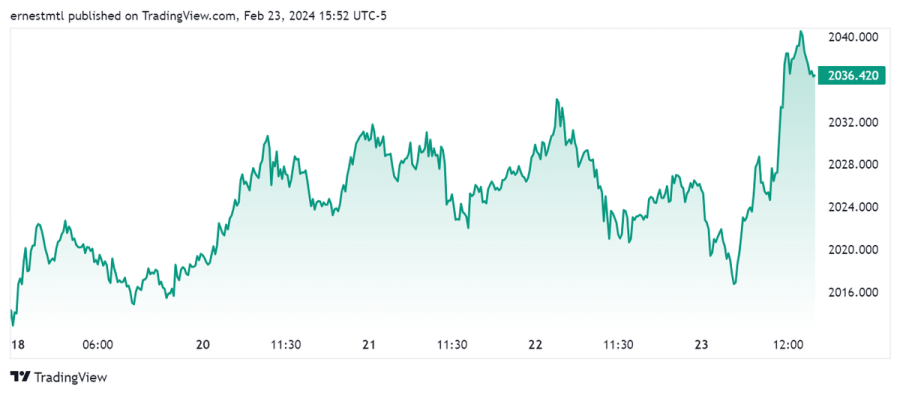

With the seasonal boost of the Lunar New Year and Valentine’s Day in the rearview mirror, the gold market saw relatively little volatility in the price action this week. Spot gold spent much of the week trading in a $10 range between $2,020 and $2,030 per ounce, though the weekly chart looks more dramatic, as the low of $2,012.81 was set near the open during the overnight session on Sunday evening, while Friday afternoon saw a late push to the weekly high of $2,041.41.

The latest Kitco News Weekly Gold Survey showed Main Street holding steady with a relatively balanced but overall bullish posture heading into the final week of February, while Wall Street analysts abandoned the bear cave to gear up for another projected bull run.

Adrian Day, President of Adrian Day Asset Management, was among those who see further gains for gold next week. “After declining earlier on indications that the Federal Reserve would delay rate cutting after optimistic expectations, the market is now brushing off those issues,” he said. “The underlying fundamentals are positive and supporting gold.”

“I’m sticking with ‘up’ for next week,” said James Stanley, senior market strategist at Forex.com. “USD bulls had an open door after the CPI report last week but given the reaction to the Austan Goolsbee comment about not getting ‘flipped out’ about a single inflation print, that says to me that the Fed really doesn’t want to entertain hawkish policy options at the moment. It’s not really a single inflation print: Core CPI has oscillated around 4% for the past five months, but the fact that the Fed has talked this down is meaningful. And the market reaction so far seems to agree.”

“The other side of that is that the European Central Bank has been holding firm regarding rate cuts and given the large allocation of the Euro in the DXY quote, that could similarly keep pressure on the USD next week, which I expect to be a positive for Gold,” Stanley added.

Adam Button, head of currency strategy at Forexlive.com, took the opposite view of the Fed’s likely response to hot data. “If we get a few more upside economic data surprises, the Fed will start to lose its dovish bias,” he said. “If so, we could see significant declines in gold.”

“The biggest risk to gold right now is if we get hot inflation data again, because a lot of this move right now is safety buying, flight to safety, but also the expectations that there's rate cuts coming sooner than later,” said Bob Haberkorn, Senior Commodities Broker at RJO Futures. “The last monthly data that came out pushed those expectations back further, there's still talk of June, but maybe September.”

Haberkorn said gold has formed a nice base around 2000. “It’s gone through there a few times, but just the geopolitical risk that's possibly on the horizon, coupled with U.S. elections this year, and the expectations of the Fed, has kept gold at that nice support level of $2,000,” he said. “Any dips below there have been getting bought up pretty quick.”

He said that next week, the main things for gold traders to watch will be Treasury yields and the stocks. “The strength in the U.S. equity markets really put a cap on what gold could do this week,” he said. “It's risk-on environment here versus flight-to-safety buying. I think the headline PCE and any Fed speak next week on rate hikes and rate cuts is going to be the next main driver here. I expect gold to remain in this range into the next Fed announcement.”

Haberkorn believes the upcoming Fed speakers will remain consistent in their message. “If one of them does hint towards something with cuts sooner than later, that would be extremely beneficial for the gold bulls at this point,” he said. “But it's pretty impressive that gold has maintained $2,000 given the spot where our interest rates are at. It just highlights the fear that's out there in the world at this point that has strong demand across the board here for gold assets.”

This week, 11 analysts participated in the Kitco News Gold Survey, and Wall Street has done a near-total about-face on gold’s prospects from last week. Eight experts, or 73%, expected to see higher gold prices next week, while one lone analyst, representing 9%, predicted a price drop, and two experts, or 18%, expected gold prices to trade sideways during the coming week.

Meanwhile, 203 votes were cast in Kitco’s online polls, with Main Street maintaining the same basic distribution of views it had last week. 89 retail investors, representing 43%, looked for gold to rise next week. Another 52, or 26%, predicted it would be lower, while 63 respondents, or 31%, were neutral on the near-term prospects for the precious metal.

As the Fed’s key measure of inflation, Thursday’s PCE price index will be the highlight among releases next week, but there’s a full docket beyond inflation data. Markets will also be watching new home sales on Monday, durable goods orders and consumer confidence on Tuesday, Wednesday’s Preliminary Q4 US GDP report, pending home sales on Thursday, and ISM manufacturing PMI on Friday.

Darin Newsom, Senior Market Analyst at Barchart.com, sees the technical picture trending solidly green next week. “The short-term trend on April’s daily chart looks to have turned up,” he said. “Initial resistance could be at the recent high of $2,045.50. Beyond that the target is up at $2,061.30, then $2,083.20.”

“Gold rallied five of the past six sessions coming into today,” said Marc Chandler, Managing Director at Bannockburn Global Forex. “The Dollar Index has also fallen in six of the last seven sessions before today.”

Chandler said he expects the dollar to continue to trend lower, as he believes the interest rate adjustment is nearly over. “The market has converged to the three rate cuts the median Fed dot pointed to in December,” he said. “The momentum indicators are turning up. I think there is scope for spot gold to trade toward $2050 in the week ahead.”

He noted that this month’s high near $2065.50 was set on Feb. 1. “Maybe we can see that on a soft employment report on March 8,” Chandler added. “That said, some demand for gold was reported from China, but with higher stocks, FOMO may see less demand for gold for Chinese investors.”

Colin Cieszynski, Chief Market Strategist at SIA Wealth Management, was looking at the upward move in gold markets on Friday.

“I think it might be risk-off,” he said. “We saw earlier in the week, and over the last couple of weeks, when Bitcoin really shot up, gold was really struggling, so I always look at gold versus the U.S. dollar, and then tier-two is gold versus Bitcoin, because when you have people that are looking to trade alternative assets, when they're risk on, they'll trade cryptos, and when they're risk off, they'll do precious metals.”

Cieszynski said gold’s move isn’t so much about people getting fearful, but just an easing of risk appetite now that we're past earnings season. “Every single major piece of news is now out,” he said. “With the Nvidia earnings, Cisco, all the big names have now reported results in the U.S., so we're really at the end of earnings season now. We don't have any of those things coming in to drive more risk appetite.”

He noted that if we see profit taking in the risk markets, that could be beneficial for gold. “I'll go bullish on gold next week,” he said. “It's not necessarily that there's a negative event, it's just a lack of events to keep the party going.”

Cieszynski said that while next week’s PCE report is important, markets tend to underreact to it. “PCE usually is seen as more confirmation,” he said. “I still think most mainstream people don't understand PCE, so they all go off and look at the other ones. In fact, the markets often willfully ignore it in favor of CPI. Whereas if you look at PCE, you can see a mile away what the Fed is going to do.”

Turning to the timing of the Fed’s pivot, Cieszynski said the Fed will actually want to deliver the first rate cut in June if the data allows it, and the timing of the election is a key consideration.

“If you're going to do three rate cuts quarterly, then you'll start at the end of June,” he said. “You'll do June, September, and December. That kind of says, ‘we're on a regular thing,’ and it keeps them away from the election.”

“If they go September, then you'd be talking about them trying to do a rate cut at the end of October, and that's not realistic. They're not going to do anything,” he said. “Let's put it this way: If they don't cut rates at the end of June, then you're looking at two rate cuts, not three, because you're not going to go July-September-November. You might go July-September-December, but they don't seem to like doing that anymore.”

Cieszynski emphasized that the move wouldn’t be about making markets happy, rather it’s about getting on a rate cutting path that works with the election calendar and aligns with their history.

“They don't want people going, ‘the Fed is on, the Fed is off, the Fed is on,” he said. “They don't want it, because that creates instability and undermines confidence. They don't want the Fed to be the wild card. As much as they say they're data-dependent, once they start a program, they try to be fairly consistent and not keep everybody guessing.”

Mark Leibovit, publisher of the VR Metals/Resource Letter, believes U.S. government manipulation is restraining gold’s strength, but foreign buyers are driving the price action regardless.

“Commentary had virtually no reference to government suppression of price,” he said. “Despite that, the physical market outside the U.S. is taking control from the COMEX. Adding to positions on manipulated shakeouts.”

And Kitco Senior Analyst Jim Wyckoff sees gold prices still stuck in their recent channel next week. “Steady and sideways,” he said. “Stiff technical support levels lie just below the market. Yet, there has been no fundamental catalyst to inspire the bulls to get more active on the long side.”

Sot gold last traded at $2,036.09 at the time of writing, up 0.58% on the day and 1.14% on the week.

Kitco Media

Ernest Hoffman

David