Gold’s shock rally has analysts grasping for explanations

.jpeg)

Gold’s surprising rally to new all-time highs has even seasoned industry professionals scratching their heads as to the true cause.

“It is clear that despite the West's disaffection for gold […] demand in China is more than offsetting the shortfall, with monumental volumes flowing from West to the East,” wrote Metals Daily CEO Ross Norman in a LinkedIn post. “As such, this rally seems to have caught Western experts and forecasters by surprise – a stealth rally if you like – which suggests to me the buying is beyond the immediate purview of most of us.”

Norman said the “conventional explanation” is that gold is rallying ahead of an expected rate cut at the June Fed meeting, which would weaken the dollar and strengthen gold, “but the dollar is actually up YTD and silver is not validating the move higher in the complex as evidenced by a decline in the gold/silver ratio as we would have expected.”

Another possible explanation would be the decline in U.S. treasury yields, “down 1.2% in the last month and with gold up nearly 6% … but again no evidence that institutions are behind this as ETF demand remains lacklustre.”

Norman said that there’s no doubt that short covering in the futures market has helped boost the rally, but the move is too big for that to be the main driver, “so something else is at play.”

“A significant part of the answer is of course Chinese buying and not just the traditional 'dama' or Chinese grandmothers – Gen Z investors have joined the fray,” he wrote. “But Chinese premiums are slipping (down from a strong $45 premium to $38) as have Indian premiums (down from $5 discount to a $16 discount) suggesting Asia is behaving in a moderately price-elastic manner and easing back on purchases in the face of price strength.”

Norman said he believes the shock rally is being driven by central bank buying, which continues to be very strong according to the latest January numbers.

“With the US moving beyond simple sanctions and threatening to sequester $300 billion in Russian financial assets (to be sold and paid across to support Ukraine) … some Central Banks … even the non-aligned ones, will be alarmed for fear that they might be in the firing line themselves at some point potentially,” he wrote. “It follows therefore that they might prudently wish to diversify into non-dollar assets.”

James Steel, an analyst at HSBC Holdings PLC, told Bloomberg in a report that the scale of the move is surprising given that there hasn’t been a significant change in rate cut expectations or another clear macroeconomic driver.

“The velocity and the speed were very sudden, very fast,” Steel said. “It didn’t seem to have a smoking gun.”

Ole Hansen, commodity strategist at Saxo Bank, said that the ISM manufacturing PMI data for February released on March 1, which came in well below expectations, highlighted the rising risk of a stock market correction, and may have prompted some investors to move from equities to gold.

TD Securities commodity strategist Ryan McKay believes that macro funds and momentum buying by commodity trading advisors contributed to gold’s sudden gains, with the latest Commodity Futures Trading Commission data showing hedge funds and money managers increasing their net bullish gold bets as of Feb. 27. Still, McKay noted that these investors added short positions roughly in line with new longs, meaning they’re not all in on gold’s upward move either.

The report noted that gold’s recent rally has also highlighted the growing disconnect between spot prices and gold-backed ETF outflows. “Holdings in SPDR Gold Shares, the world’s largest such ETF, fell by 0.3 per cent on March 4, taking the total to the lowest level since July 2019, according to data compiled by Bloomberg,” they wrote. “Those outflows have partly been offset by persistent central bank demand for the precious metal, which helped keep prices elevated even as real interest rates spiked last year.”

They also pointed out that physical demand for gold bars and coins also absorbed the gold that was sold by ETFs, and a strong Lunar New Year saw Chinese consumers buying gold as a hedge against the country’s beleaguered stock markets and real estate sector.

Ewa Manthey, commodities strategist at ING, believes the rally is being driven by a combination of rate cut expectations and geopolitical turmoil. “Speculation over a Fed rates pivot and continued geopolitical tensions keep gold shining,” said Manthey. “We expect gold prices to trade higher this year as safe-haven demand continues to be supportive amid geopolitical uncertainty with ongoing wars and the upcoming U.S. election.”

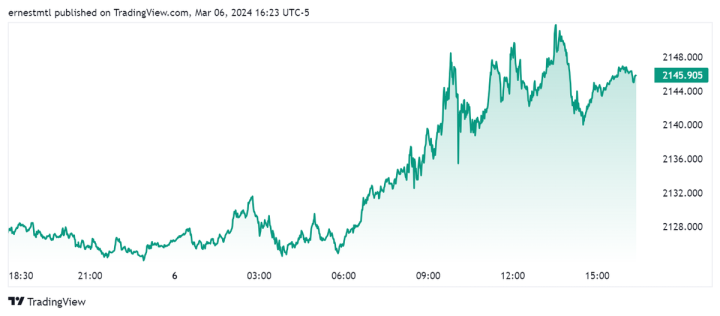

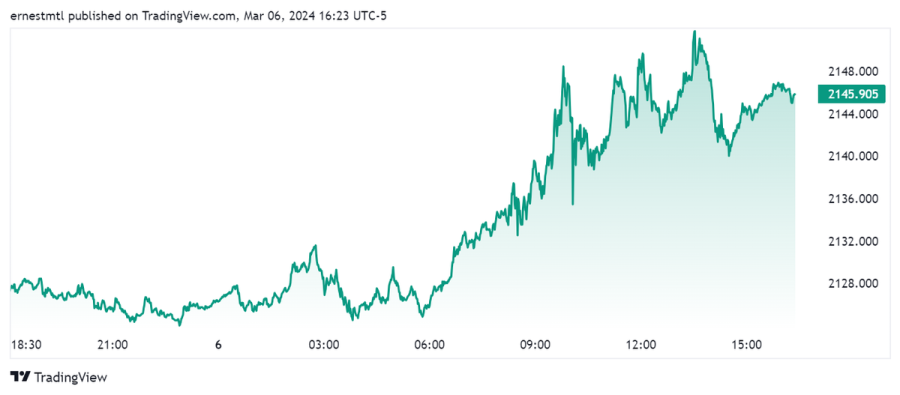

Spot gold hit a high of $2,150 per ounce around noon EST as Fed Chair Jerome Powell presented the central bank’s semiannual Monetary Policy Report to the U.S. House Financial Services Committee. It last traded at $2,148.90, up 0.84% on the day at the time of writing.

Kitco Media

Ernest Hoffman

David