Gold, silver firmer as bull-market runs remain strong

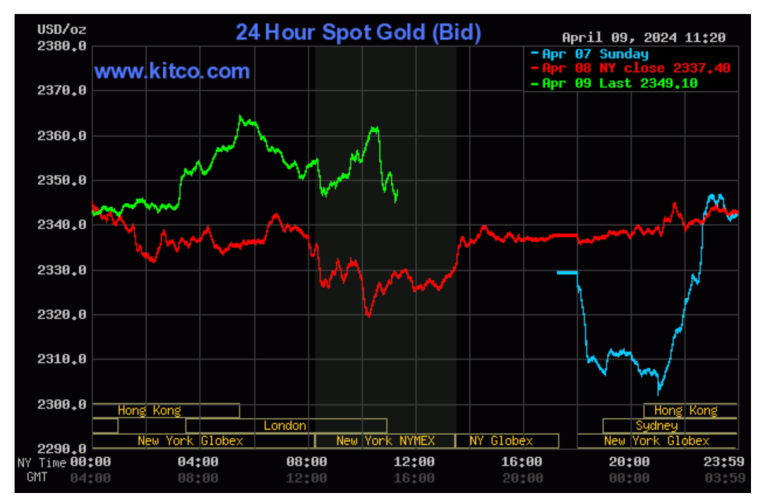

Gold prices are higher and hit another record high overnight, with June Comex gold reaching $2,384.50. Silver prices are slightly up and hit a nearly three-year high overnight, at $28.44 basis May Comex futures. More and more traders of all markets are climbing aboard the bullish gold and silver train, suggesting still more upside price potential in the near term. Save-haven buying remains a feature in both metals. June gold was last up $12.80 at $2,363.90. May silver was last up $0.073 at $27.875. Gold is presently outperforming the S&P 500 so far this year.

U.S. stock indexes are weaker near midday. It’s a quieter U.S. data day again Tuesday but the pace picks up Wednesday. The releases of the March consumer price index and the minutes of the last FOMC meeting will come at mid-week. The March CPI is seen coming in at up 3.4%, year-on-year. The core CPI, excluding food and energy, is seen at up 3.7% annually. Thursday comes the U.S. March producer price index and the European Central Bank monetary policy meeting.

The key outside markets today see the U.S. dollar index slightly lower. Nymex crude oil prices are weaker and trading around $85.75 a barrel. The yield on the benchmark 10-year U.S. Treasury note is presently fetching around 4.25%.

Technically, June gold futures bulls have the strong overall near-term technical advantage. A seven-week-old uptrend is in place on the daily bar chart. Bulls’ next upside price objective is to produce a close above solid resistance at $2,400.00. Bears' next near-term downside price objective is pushing futures prices below solid technical support at $2,250.00. First resistance is seen at today’s contract high of $2,384.50 and then at $2,400.00. First support is seen at today’s low of $2,355.70 and then at this week’s low of $2,321.70. Wyckoff's Market Rating: 9.0.

May silver futures prices hit nearly three-year high today. The silver bulls have the solid overall near-term technical advantage. An accelerating seven-week-old price uptrend is in place on the daily bar chart. Silver bulls' next upside price objective is closing prices above solid technical resistance at $30.00. The next downside price objective for the bears is closing prices below solid support at $26.40. First resistance is seen at today’s high of $28.44 and then at $29.00. Next support is seen at today’s low of $27.725 and then at $27.50. Wyckoff's Market Rating: 8.0.

May N.Y. copper closed up 50 points at 428.10 cents today. Prices closed nearer the session low and hit a 14-month high early on today. The copper bulls have the solid overall near-term technical advantage. Prices are in a two-month-old uptrend on the daily bar chart. Copper bulls' next upside price objective is pushing and closing prices above solid technical

resistance at 450.00 cents. The next downside price objective for the bears is closing prices below solid technical support at 400.00 cents. First resistance is seen at today’s high of 433.35 cents and then at 437.50 cents. First support is seen at today’s low of 425.25 cents and then at 420.00 cents. Wyckoff's Market Rating: 8.0.

Kitco Media

Jim Wyckoff

David