Gold stuck around $2,050 as markets look for guidance on Fed cuts next week

Kitco News

The Leading News Source in Precious Metals

Kitco NEWS has a diverse team of journalists reporting on the economy, stock markets, commodities, cryptocurrencies, mining and metals with accuracy and objectivity. Our goal is to help people make informed market decisions through in-depth reporting, daily market roundups, interviews with prominent industry figures, comprehensive coverage (often exclusive) of important industry events and analyses of market-affecting developments.

Gold stuck around $2,050 as markets look for guidance on Fed cuts next week teaser image

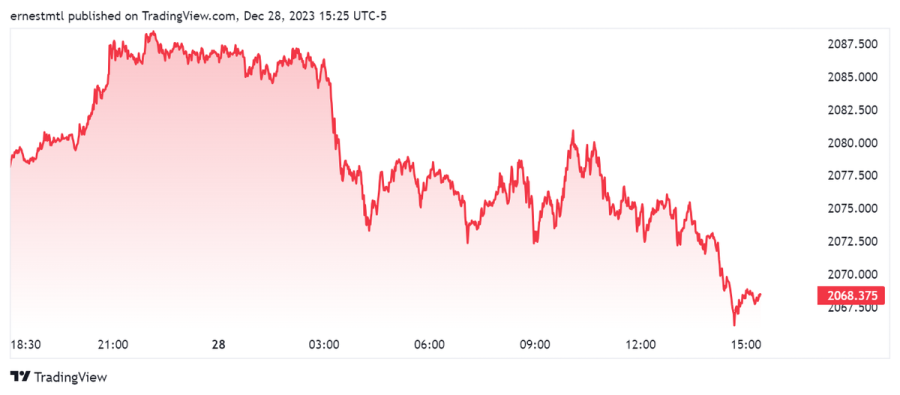

According to many analysts, the gold market is off to a decent start after the first trading week of 2024 even as the price lost some ground as it consolidated at elevated levels between $2,000 and $2,050 an ounce.

February gold futures are ending the week around $2,050 an ounce, down 1% from last week.

According to some analysts, the market remains caught in a tug-of-war as investors try to anticipate the Federal Reserve’s next move. Markets are currently pricing in a 68% chance of the first rate cut at the March monetary policy meeting.

However, some economists have said that after December’s employment numbers, it is unlikely that the U.S. central bank will be ready to cut rates that early in the new year. The latest employment data shows 216,000 jobs were created last month and wages grew by 0.4%.

“The jobs report lends credence to the view that the Fed is likely to continue pushing back against the early rate cuts being priced in by the market until the signal becomes clearer,” said fixed income analysts at TD Securities. “With that said, we do expect inflation to continue softening over the next few reports, which should keep the door open for rate cuts in Q2.”

At the same time, Philip Streible, chief market strategist at Blue Line Futures, said that rate cut expectations remain elevated because some analysts believe the latest jobs report shows cracks in the labor market are starting to appear. He noted that a high number of government jobs in the December report appear to be skewing the data.

Streible added that with a March rate cut on the table, gold should be well supported above $2,000 an ounce; however, he added that he doesn’t know if there is enough momentum to push prices solidly above $2,050 an ounce.

“Right now is a coin flip and that will keep gold in this consolidation range,” he said.

James Stanley, senior market strategist at Forex.com, said that the price action this week indicates that gold is capped at $2,050 in the near-term; however, he added that the gold bears will find a difficult path on the downside as the Federal Reserve is still expected to lower interest rates this year.

“Think this resistance will hold long enough to give a dip… but that may take a month or two,” Stanley said. “When the Fed does formally pivot this thing can take off. But real rates will need to get higher first before they can declare a ‘W’ on inflation, and with an election year I think they'd want to have that pivot a little closer to November. Ideally [gold] should push below 2k and wash out some longs first. Then, more money on the sidelines could further propel higher.”

Although markets are back to a full five-day week next week, investors are expected to continue to digest December’s employment numbers. The main highlight comes late next week with December’s Consumer Price Index report. According to some economists, inflation data could solidify the Federal Reserve’s move in March.

Some economists have pointed out that although consumer prices have dropped from their 2022 highs, the Federal Reserve still has work to do to bring inflation down to its target of 2%.

The expectations are that headline inflation will remain around 3%; however, core inflation is expected to remain around 4%, double the central bank’s target.

Economic data for next week:

Thursday: US CPI, weekly jobless claims

Friday: U.S. PPI

Kitco Media

Neils Christensen

David

.png)

.png)

Fed's Powell confirms FOMC believes terminal rate has been reached, says outlook reflects latest CPI and PPI data

Fed's Powell confirms FOMC believes terminal rate has been reached, says outlook reflects latest CPI and PPI data

Gold to outperform silver and platinum as weak growth forces the Fed to cut rates in 2024 – Heraeus

Gold to outperform silver and platinum as weak growth forces the Fed to cut rates in 2024 – Heraeus