Investors speculate on Fed’s decision next week as inflation remains persistent

A primary purpose of holding or investing in gold is to protect one’s portfolio against high inflation. It has always been considered an inflationary hedge. Simply put, one can extrapolate that if interest rates remain elevated or spike higher it will provide bullish tailwinds supportive of higher gold pricing.

This is true with one exception; when the Federal Reserve is initiating either quantitative tightening or quantitative easing. Currently, the Federal Reserve is completing a multiyear period of quantitative tightening in which they have raised interest rates from historic lows of 0% to a ¼%, all the way to between 5 ¼% and 5 ½%.

Higher interest rates exude a bearish influence on gold because gold does not contain any intrinsic yield. When fixed income assets such as treasuries have high yields it diminishes the allure for gold. This scenario is the economic environment that we find ourselves in today.

One-Two Punch

This week two important reports revealed new data concerning current inflationary pressures. The Consumer Price Index revealed that inflation for February came in hotter than expected. Yesterday’s release of the most current Producer Price Index revealed that producers raised the price of their goods by 0.6% during the month of February. Because a hot PPI is a precursor to a hot CPI we can expect that inflation this month could continue to be elevated.

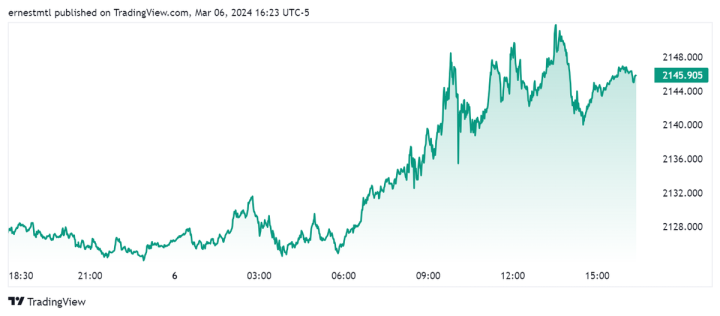

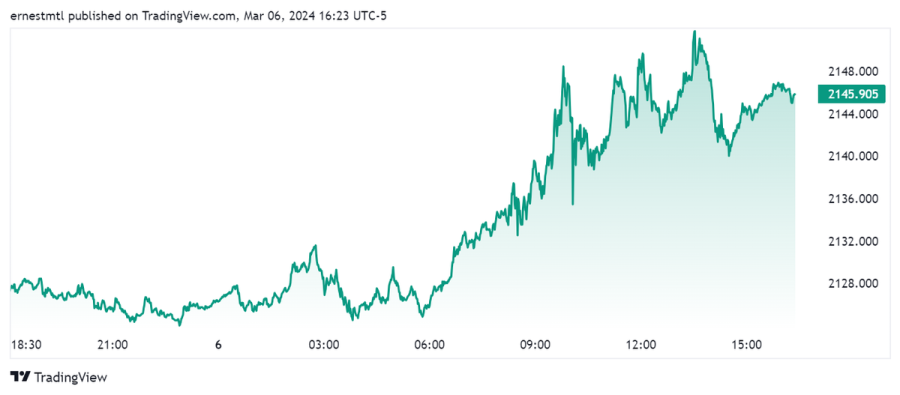

This has pressured gold off the highs achieved last Friday. Tuesday's release of the CPI took gold futures down $25, and on Wednesday gold recovered gaining back approximately $15 of Tuesday’s decline. For the remainder of the week, gold softened but still did not trade to a lower low than the low achieved on Tuesday.

One week ago, gold futures challenged $2200 per ounce and traded to a high of $2203. The price of gold above $2200 for the first time in history was short-lived, but the fact that gold has remained above $2150 all week is a sign that a base is being formed, and we may see that price tested again soon. Gold has been extremely resilient and able to hold onto most of its recent gains even with moderate headwinds from dollar strength, and higher treasury yields.

As of 6 PM EDT, gold futures basis the most active April contract is currently fixed at $2159.40 after factoring in today’s modest decline of $7.10 or 0.33%.

Market participants will now begin to enter a “wait-and-see mode” as the Federal Reserve will begin the March FOMC meeting. According to the CME’s FedWatch tool, it is almost a certainty that they will not announce or initiate any rate cuts for March. They will however release their most current economic outlook and release a revised “dot plot” an integral component of the SEP (summary of economic projections). The dot plot released in February anticipated that the first set of rate cuts by the Federal Reserve would begin this year and anticipated that they would cut rates by three-quarters of a percent. They also projected continued rate cuts in 2025, and 2026 as they “normalize” its benchmark interest rates (fed funds rate) just above 3%.

If there are no major changes in the dot plot released next week in essence that information should already be factored into current pricing and be supportive of gold prices maintaining value.

Gary S. Wagner

David

.jpeg)

.png)