Bitcoin (BTC) Finds Support at $4,200, What Next?

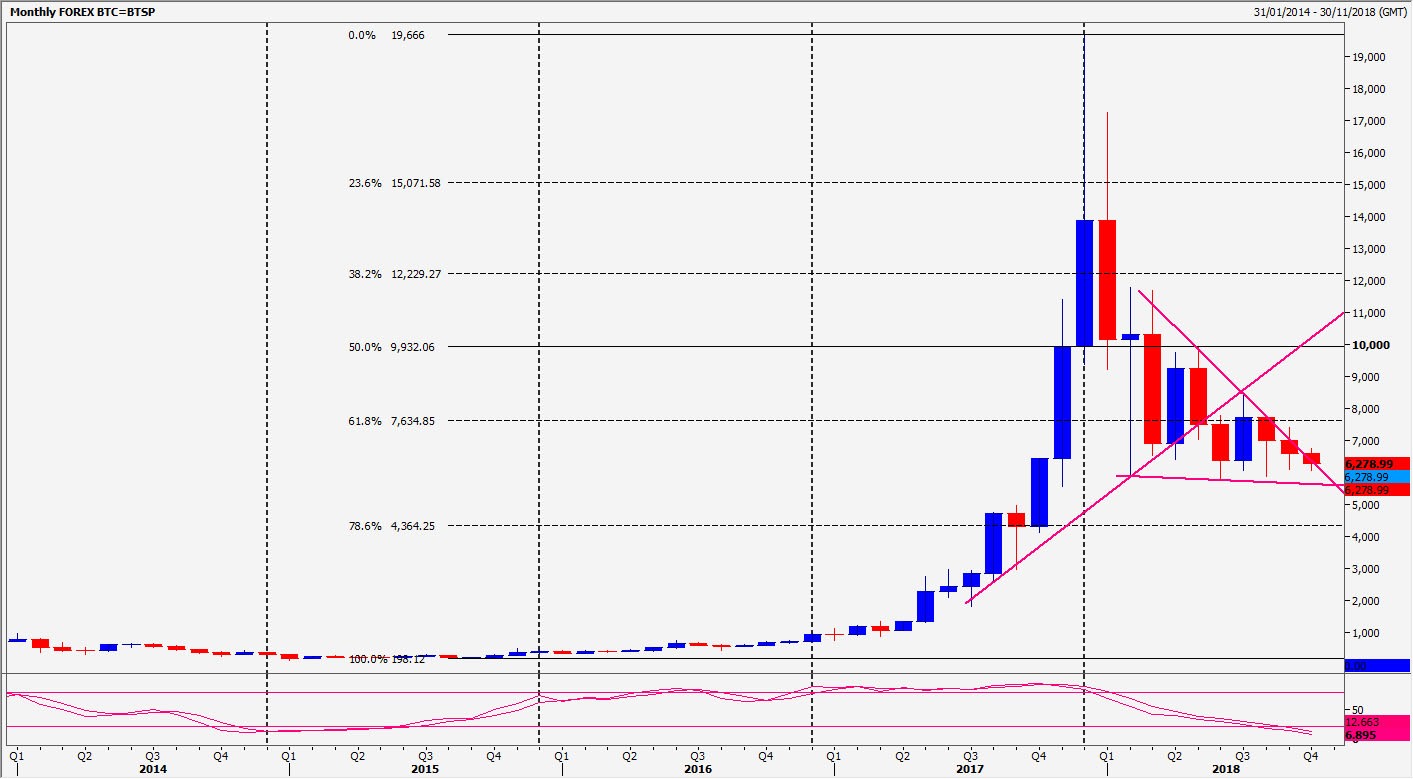

After a brief recovery mid-week that hinted at a possible bottom found, a fresh crash has decimated the cryptocurrency market this morning. After dipping sharply from $4,440, Bitcoin (BTC) managed to find support at $4,200, which has long been considered a critical support level. Should it breach it, though, the next test will likely be $3,000 – the level that buoyed up the markets in the brief September dip last year before the epic late November rally.

While last weeks drops have been attributed by some to be investors selling assets ahead of Black Friday, these new losses are too close to the time for that explanation. It’s more likely that these continuing declines are fuelled by a number of factors, including depressed tech stocks as a result of the on-going China-U.S. trade war, the DOJ’s Tether manipulation probe and the Bitcoin Cash (BCH) war that is driving hash power away from Bitcoin mining.

There is also mounting evidence to suggest price manipulation by Wall Street whales in order to accumulate ahead of the ICE’s Bakkt launch, although that little nugget of hope has now been delayed until late January next year, so if true, we may see similar dips again after New Years.

Black Friday Fever

Several exchanges have chosen to take advantage of Black Friday fever and sell assets at discount prices, with some going as far as giving away Bitcoin for free. Unfortunately, while these actions may grow adoption, they also serve to further devalue cryptocurrencies in the short term.

After the drop to around $4,150 on some exchanges earlier today, Bitcoin has shown signs of recovery, rallying up to the $4,250 range more recently. Whether or not this support will hold is unclear, with many bearish analysts becoming more and more convinced that Bitcoin’s real bottom is likely to be in the $3,000 range. Should it maintain support above $4,200, the next resistance level is $4,720 with strong resistance at $4,830.

Any analytical comparisons to last year’s epic mid-December bull run don’t hold up within today’s vastly altered landscape. In light of the BCH hash war, tighter SEC regulations, more substantial institutional interest, and an entirely different psychological viewpoint, to assume a similar event would happen this year is optimistic at best. However, considering that last years rally was almost certainly the result of market manipulation and left the majority investors in debt, maybe that’s a good thing.

AUTHOR Mark Hartley November 23, 2018, UTC, 4:41 am

David