![Bitcoin [BTC] Breaches $6000 - Time for a Pullback or Locking New Targets?](http://seriouswealth.net/wp/wp-content/uploads/2019/05/screenshot-coingape.com-2019.05.09-05-34-28.png)

Bitcoin [BTC] Breaches $6000 – Time for a Pullback or Locking New Targets?

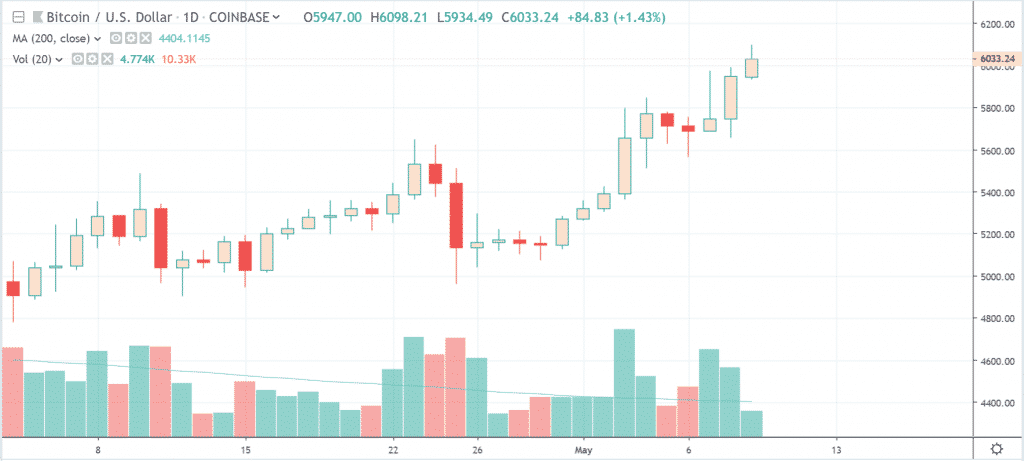

Bitcoin finally breached $6000 on 9th May 2019. The momentum toward Bitcoin [BTC] was high this week as it held above the $5700 mark. Moreover, it was barely affected by the Binance hack, which affected one of the largest cryptocurrency Exchanges in the world.

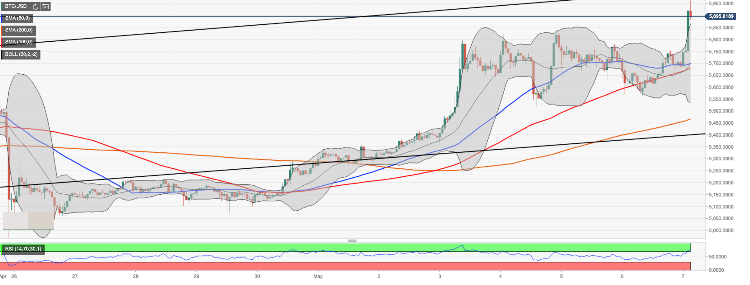

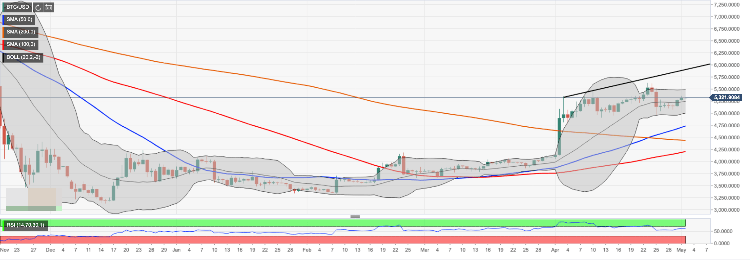

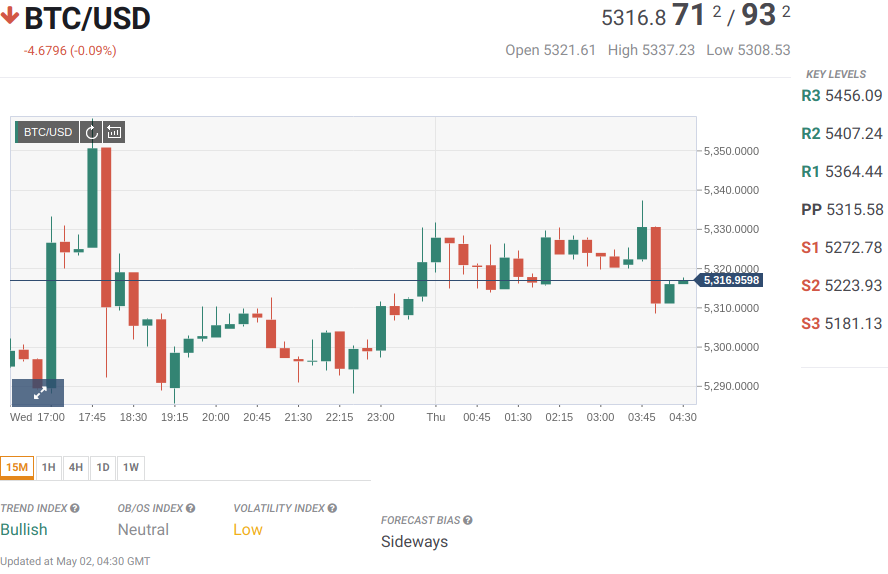

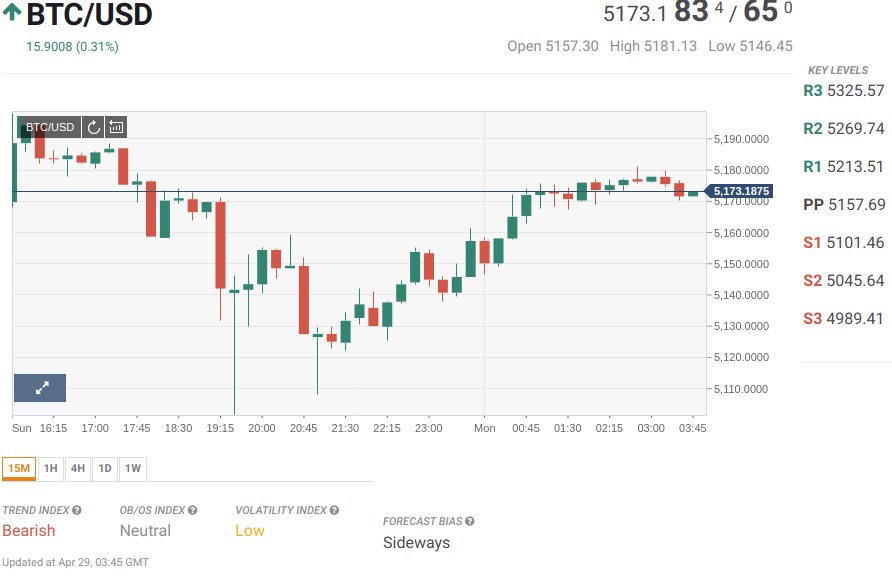

The price of Bitcoin [BTC] at 3: 40 Hours UTC on 9th May 2019 is $6060. It is trading 3.34% higher on a daily scale. The ‘bull run’ as expected might have begun as Bitcoin is closing near two times the bottom (near $3150) price. The dominance of Bitcoin over the cryptocurrency market is 56.8% and the total market capitalization is above $107 billion.

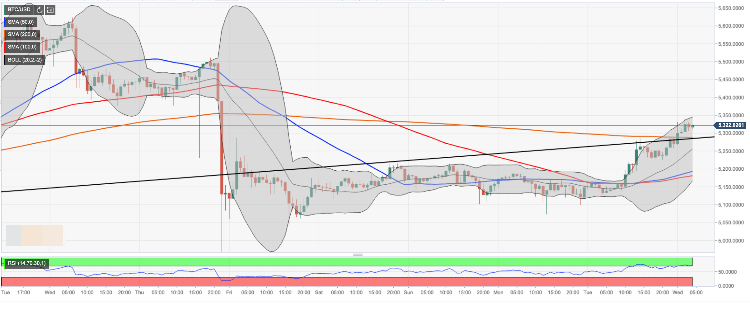

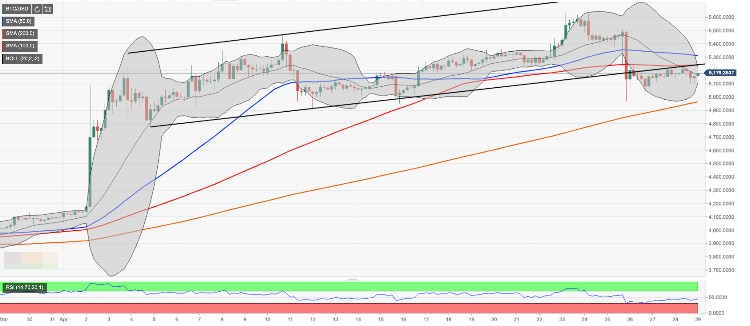

BTC/USD 1-Day chart on Coinbase (TradingView)

Should We Expect a Pullback?

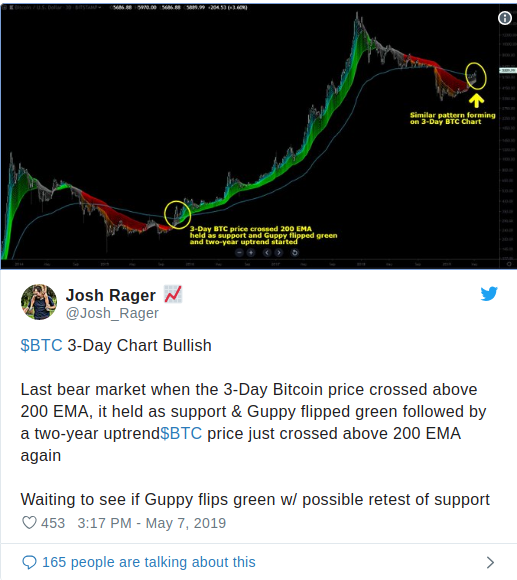

While a strong buying momentum is built up, making traders apprehensive of the next bull run, some bears maintained their stance. Tone Vays, a leading trade analyst on Bitcoin is expecting a “pullback.” He said,

“We’ve not had any significant pull back in bitcoin for a long time.”

The bear case from here according to Tone Vays’ analysis was based on sequential on a daily chart which reached a high at $5974. He also asserted that the ‘probability of a pullback has increased’ now. Nevertheless, he also predicted that a sequential 1 and 2 above the 9 would set up for another leg up with targets near $6150.

Nivesh Rustgi 1 min ago

David