Bitcoin – The Price is Making a Revival – Will it Last?

2018 was a troublesome year for cryptographic forms of money, besides the last two months have been significant all the more trying for the main advanced currency, Bitcoin. In November, Bitcoin exchanged at under $4000, the most minimal amount it has landed since October 2017. This value drop sent rushes of fear over the market even as the costs of different digital forms of money drove in a pattern that kept going for several weeks.

Current Statistics

As per the recent survey, the number of digital currency users hit 35 million records in 2018, up from 18 million in the year 2017, and 5 million in the year 2016. The number of cryptographic money accounts additionally expanded significantly to achieve 139 million in 2018, up from 85 million out of 2017.

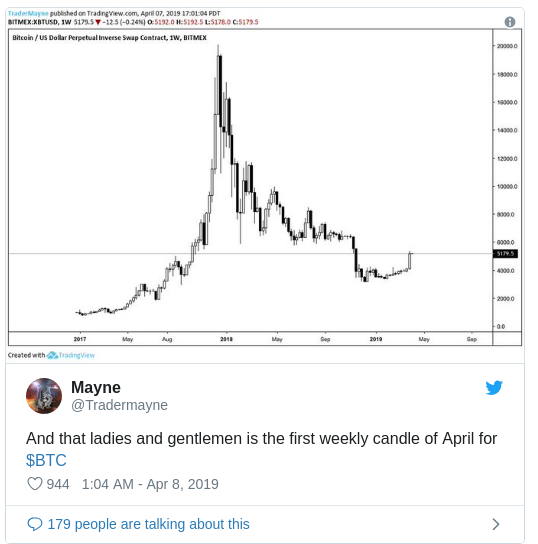

Towards the end of March, after the Bitcoin cost had raised by 25% from its mid-December low, a new Bitcoin bull market trending business sector was in advancement, and the estimation of the cryptographic money could rise significantly further as speculators came back to the asset.

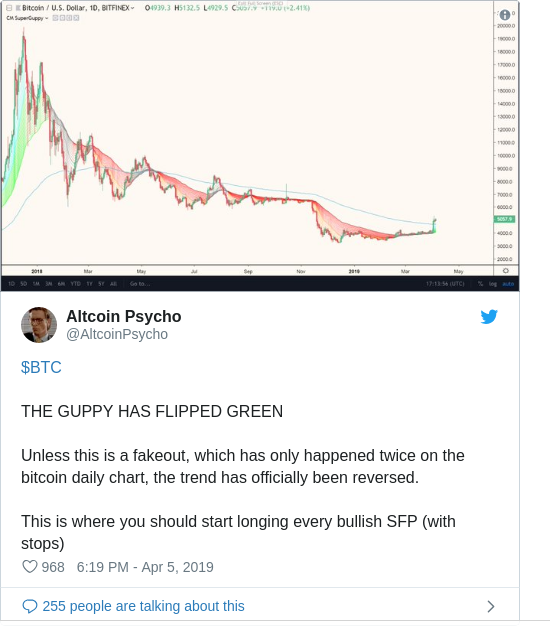

Key indicators which demonstrate that the traders are returning

Bitcoin Price rises practically 25% in February alone. The cost of Bitcoin on Binance has gone from $3350 on 29th January 2019 to $4198 on 24 Feb 2019, rising practically 25% under one month.

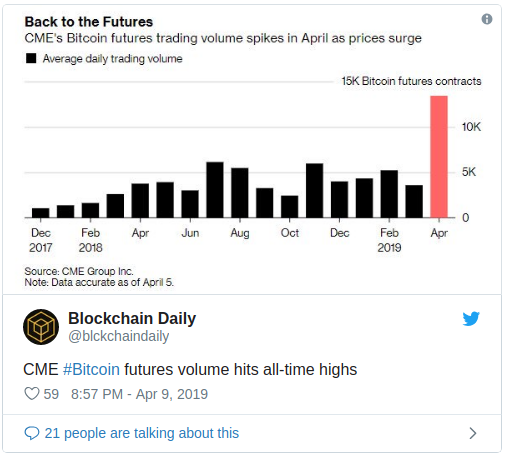

Bitcoin Trading Volume is developing steadily. The number of bitcoins being exchanged has been consistently growing since the last couple of months. The volume development is not merely on the crypto trades yet additionally on P2P (Peer-to-peer) platforms like local bitcoins. Moreover, the number of exchanges being recorded on the Bitcoin blockchain is on rising.

Exchanging Activity on Binance achieves an unequaled high. Binance is one of the top trades for exchanging digital forms of money with a robust exchanging framework. It encountered a system overload on Sunday when the exchanging action hit a record-breaking high. This means that traders are returning to the market.

So, considering how the cost of Bitcoin has moved since December a year ago, it is unmistakable that crypto resource is making a rebound. The specific issue presently is how long this will last.

Demand

It is continuously precarious to attempt and tell what the standpoint is for the cost of an asset as the future is doubtful. This is especially valid for cryptographic forms of money. The market is still so immature, and these technical resources do not produce money flows, so it is confused to work out the amount they are individually worth. What we do know is that interest for Bitcoin is lifting back up again, that the cost of the cryptographic money is controlled by demand. Much the same as with any stock, when there are a more significant number of buyers than vendors in the market, costs will increase. This information is confirmed by Bitcoin exchange data.

Most recent Trend

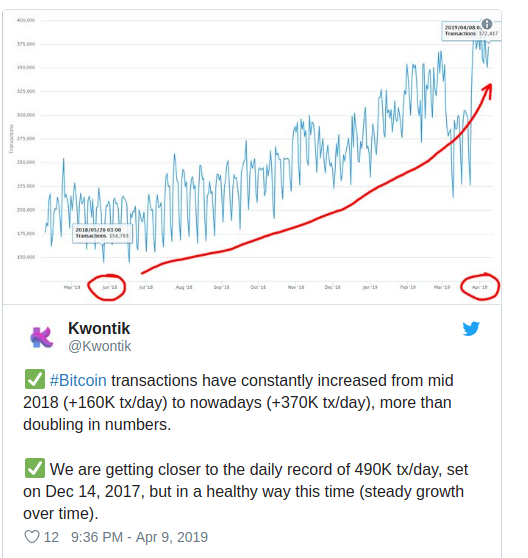

As indicated by the report, the number of Bitcoin exchanges has dramatically increased in the past months. Last year, when the cost of Bitcoin was descending from its untouched high, the number of every day affirmed trades dropped to 150,000. However, back in February, the number of day to day confirmed exchanges spiked over 300,000 and has kept rising from that point forward. The latest information proposes that more than 350,000 exchanges every day are being completed. If this pattern proceeds, we can believe it is sensible to state that Bitcoin cost will keep on ascending as more individuals get tied up with the digital currency.

Day-to-Day Transactions

Moreover, exchange information proposes that this revival in the Bitcoin cost may be more manageable than it has been before. The unprecedented high number of every day affirmed exchanges is around 405,000 a record printed toward the end of 2017 when every unit of the digital currency was valued at more than $15,000.This high cost, combined with the unpredictability that accompanied it, without a doubt scared away many potential assets. From that point forward, the price has balanced out and, at just $5,100 a piece, it is currently less expensive to execute in Bitcoin. This appears to propose we could see the number of day by day exchanges break another high in the near term.

Wrap up

Generally speaking, the way that more individuals are utilizing Bitcoin suggests the cost may rise further from current dimensions. Following a challenging last year, which saw the crypto markets tumble from a stature of happiness to blankness with various skeptics writing end of bitcoin and digital forms of money in general, we are seeing new indications of crypto-markets returning to life.

Scott Cook

April 14, 2019

David

c

c