Bitcoin – Bears Fail to Take a Bite, as Bitcoin Holds onto $4,000

Bitcoin holds onto $4,000 levels through the early hours. The bulls will be targetting $4,200 levels, but resistance will be high at $4,100.

Bitcoin fell by 1.14% on Thursday. Reversing a 1.63% gain from Wednesday, Bitcoin ended the day at $4,008.8.

Following a relatively range-bound early part of the day, Bitcoin struck a mid-morning intraday high $4,145 before hitting reverse.

Breaking through the first major resistance level at $4,095.67 and second major resistance level at $4,136.33, Bitcoin broke through to $4,100 levels for the first time since 10th January.

The reversal saw Bitcoin slide to a late morning intraday low $3,918.5 before finding support. The sell-off saw Bitcoin fall through the first major support level at $3,988.67 before recovering.

A range-bound 2nd half of the day saw Bitcoin find plenty of support at sub-$4,000 to close out the day at $4,000 levels.

Elsewhere

Across the top 10 cryptos, it was a sea of red on the day. Leading the way down were Stellar’s Lumen and Litecoin. The pair fell by 5.36% and by 5.07% respectively.

While Bitcoin saw the most modest losses on the day, Tron’s TRX and Ethereum also fared relatively well under the selling pressure. Tron’s TRX ended the day with a 1.34% loss, while Ethereum dropped by 2%.

In spite of the day’s losses seen across the majors, it’s been a solid week. Leading the way is EOS, which has surged by 32.4%.

Other notable moves through the week include Binance, Bitcoin Cash ABC and Litecoin. The trio managed to see double-digit gains through to the end of Thursday.

For Bitcoin Cash, the market appears to have made up its mind. Bitcoin Cash SV fell back to the number 11 spot by market cap. With just a 2.39% rise for the current week, there may be more trouble ahead.

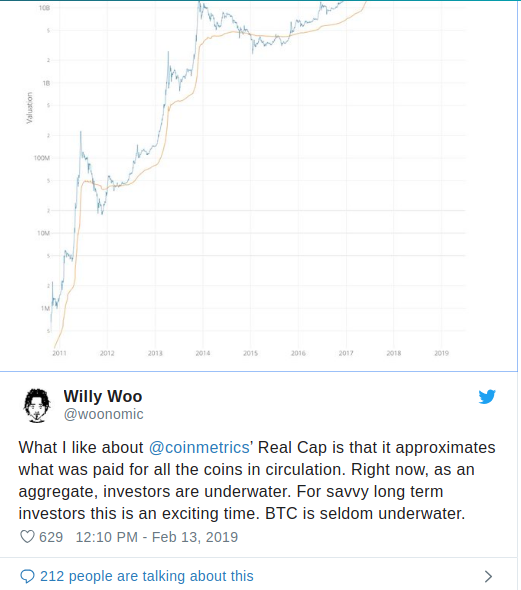

The news wires have been relatively quiet. Barring the odd bullish call from the likes of Elon Musk, a lack of negative news has supported the upward trend through February.

For the Bitcoin bulls, hopes of the SEC approving 3 Bitcoin ETF applications come off the back of some optimistic comments from VanEck in the week. The decision will be announced on the 3 applications within the next 45-days.

The timing of the SEC’s decision, assuming it’s a favorable outcome, could work out well for the Bitcoin bulls. The current market momentum will need to be maintained to support more significant inflows. Bitcoin is up by 14.4% in February. A number of daily rallies delivered the much-needed boost to reverse January’s losses.

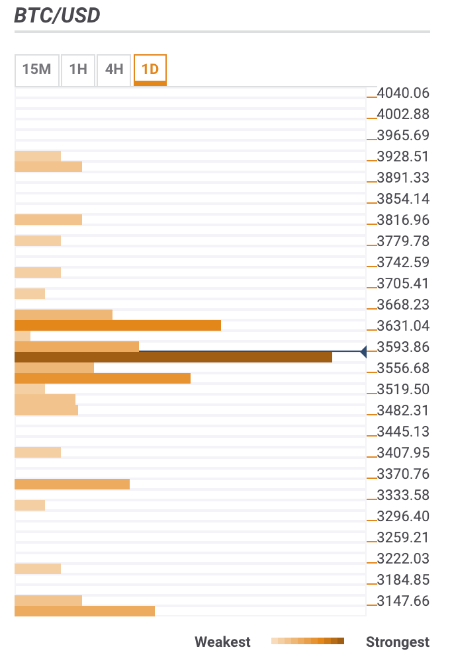

At the time of writing, Bitcoin was up by 0.38% to $4,024.2. A relatively range bound start to the day saw Bitcoin rise from a morning low $4,005.9 to a morning high $4,037.5 before easing back. The day’s major support and resistance levels were left untested through the early hours.

For the day ahead

A hold onto $4,020 levels through the morning would support a move through the morning high to bring $4,100 levels into play before any pullback. A breakthrough to $4,100 levels would bring the first major resistance level at $4,129.7 into play before any pullback. We would expect Bitcoin to fall short of $4,200 levels on the day. Thursday’s high $4,145 and the day’s first major resistance level will likely peg Bitcoin back from a breakout from $4,100 levels.

Failure to hold onto $4,020 levels could see Bitcoin hit reverse later in the day. A fall through the morning low to sub-$4,000 levels could see Bitcoin call on support at the first major support level at $3,903.2 before any recovery.

We would expect Bitcoin to steer clear of sub-$3,900 support levels on the day.

Bob Mason

1 hour ago (Feb 22, 2019 4:27 AM GMT)

David

The crypto is facing resistance at the $3,700 and $3,800 price levels. Currently, the BTC price is retracing from the recent high and has fallen to the support of the EMAs. If the price is sustained above the EMAs, the crypto is likely to resume its bullish trend. Meanwhile, the MACD line and the signal line are below the zero line which indicates a sell signal. The crypto’s price is above the 12-day EMA and the 26-day EMA which indicates that price is likely to rise.

The crypto is facing resistance at the $3,700 and $3,800 price levels. Currently, the BTC price is retracing from the recent high and has fallen to the support of the EMAs. If the price is sustained above the EMAs, the crypto is likely to resume its bullish trend. Meanwhile, the MACD line and the signal line are below the zero line which indicates a sell signal. The crypto’s price is above the 12-day EMA and the 26-day EMA which indicates that price is likely to rise.