Bitcoin Is Now Officially In Its Longest Bear Market Ever

Bitcoin has officially entered the longest stretch of declining prices in its 10-year history.

The world’s oldest and most valuable cryptocurrency achieved an all-time high of $19,764 on Dec. 17, 2017 on the CoinDesk Bitcoin Price Index and has printed a series of lower price highs ever since, making February 2 (as per UTC time), the 411th consecutive day prices have been in decline.

As such, bitcoin’s latest stretch surpasses the duration of the infamous 2013-2015 bitcoin bear market, which spanned 410 days from its price high to low.

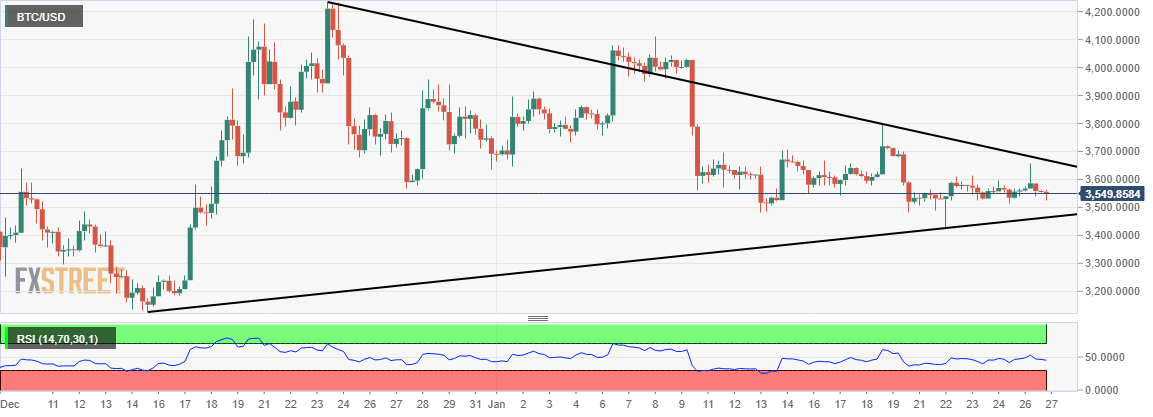

Bitcoin’s Historical Price Declines

Indeed, bitcoin’s most recent stretch of declining prices is the longest in duration ever witnessed by the cryptocurrency, but it has yet to become the worst in terms of total depreciation.

As can be seen in the chart above, bitcoin’s first significant bear market in 2011 spanned just 163 days but remains the worst performer to date.

From its price high of $31.50 to $2.01 low, bitcoin’s price fell slightly more than 93 percent, which is a steeper drop than the subsequent 2013-15 bear market when prices fell 86 percent from the previous high. The current bear market still has yet to exceed a depreciation of more than 84 percent from its all-time high, while its current prices near $3,400 register an 82 percent decline.

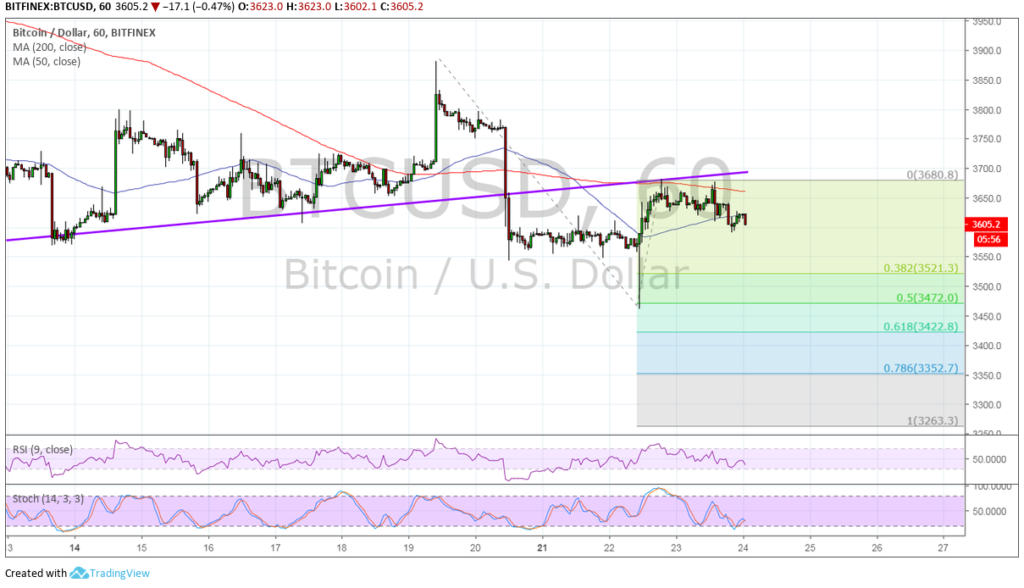

No one can be certain if or when bitcoin’s record decline will come to an end, but whether it be the market’s subdued response to the withdrawal of a highly anticipated bitcoin exchange-traded fund (ETF) proposal or bitcoin’s next deflationary halving event slowly approaching, it does seem evidence is beginning to mount for a bitcoin bottom occurring in the not too distant future.

Weekly chart and halving history

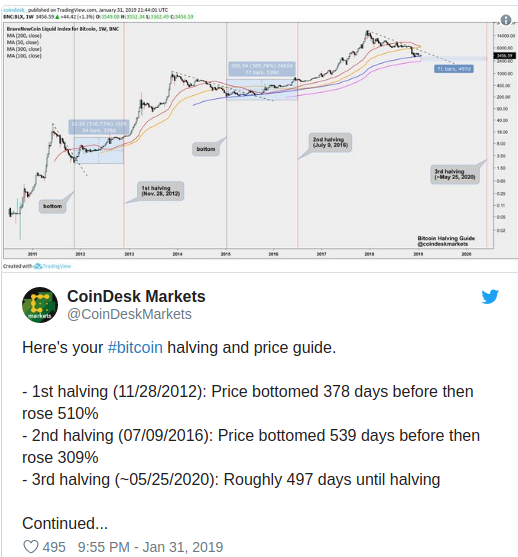

As part of bitcoin’s deflationary monetary policy, the rewards per mined block get cut in half every four years or 210,000 blocks, as a result slowing the creation of new bitcoins.

The event is now known as a “halving” and has long been considered a bullish catalyst for bitcoin’s price since the existing or growing demand for the cryptocurrency is likely to outweigh the slowing production of supply. Simply put, since demand is greater than supply, it creates a higher valuation for the underlying asset, regardless of the market.

As the tweet below from CoinDesk Markets shows, bitcoin’s price trend tends to bottom out and rise substantially several months in advance of the actual halving date.

While the sample size is small, bitcoin’s price finding a floor 378 days before the 2012 halving and 539 days before the 2016 halving creates an average “bottom” date of 458 days or one-and-a-quarter years before an actual halving event

With the next halving likely to occur in late May of 2020, bitcoin is now just under 500 days away, so a potential bear market ending bottom date may not be too far off if investors preemptively price in the deflation of supply like they have in the past.

Coin News Telegraph

02/02/2019

David