Bitcoin – No Weekend Rally in Sight as the Bulls Struggle On

Bitcoin finds support early to move back through to $6,600 levels, though holding on could be an issue for the bulls if there’s no break out to $6,700.

Bitcoin gained 0.93% on Saturday, partially reversing Friday’s 1.38% fall, to end the day at $6,585.2 and increase Bitcoins gains for the week to 3.93%.

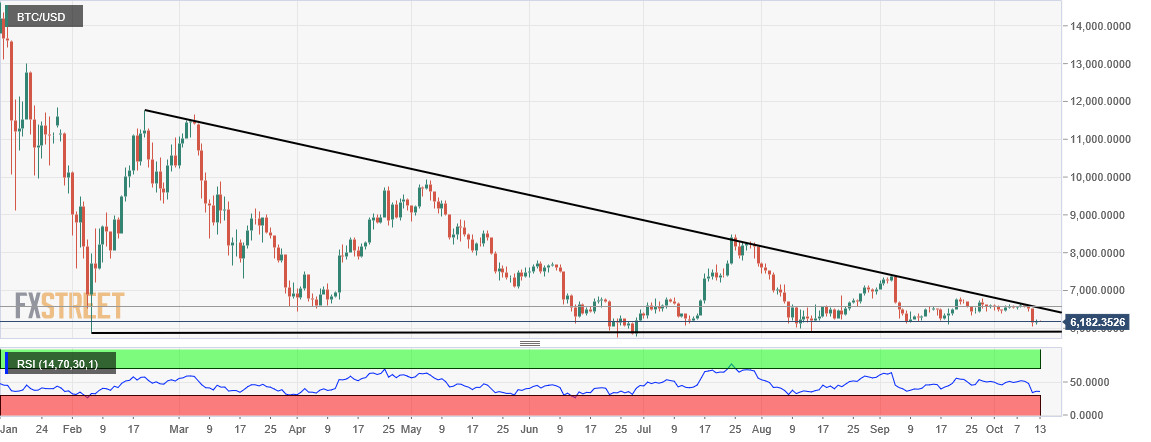

An early morning intraday low $6,511 saw Bitcoin avoid a pullback to $6,400 levels and the day’s first major support level at $6,474.97, with a broad based market rally supporting a move through the day’s first major resistance level at $6,606.27 to a late morning intraday high $6,611 before easing back to $6,500 levels.

A second break through the first major resistance level in the early afternoon saw Bitcoin struggle and fall back to $6,500 levels, with resistance at $6,600 continuing to see Bitcoin fail to break out to take a run at $6,700 levels and bring the 23.6% FIB Retracement Level of $6,757 into play.

For the Bitcoin bulls, it was another close shave, with Bitcoin managing to hold on to positive territory through the day, with the broader market also making up ground through the day, sentiment shifting from the negativity mid-week that saw Bitcoin in the red for 3 consecutive days.

On the news front, there was no material news to influence the crypto majors through the day, with upward momentum across the cryptomarket seeing Bitcoin’s dominance hover at 53.6% and the crypto total market cap rise to $210.8bn.

Get Into Cryptocurrency Trading Today

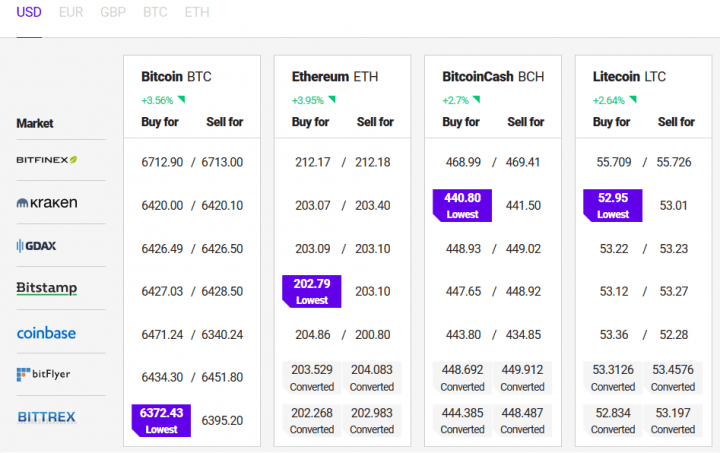

At the time of writing, Bitcoin was up 0.54% to $6,617.2, with moves through the early part of the day seeing Bitcoin bounce from a start of a day morning low $6,581.2 to a morning high $6,660.8, the start of the day rally seeing Bitcoin break through the first major resistance level at $6,627.13 to come up against the second major resistance level at $6,669.07 before easing back.

For the day ahead, a hold on to $6,600 levels through the morning would support another run through the first major resistance level to bring the second major resistance level at $6,669.07 back into play.

Breaking out from any move through the second major resistance level would need the support of the broader market, with the news wires needing to remain crypto friendly through the day.

Failure to move back through the first major resistance level at $6,627.13 could see Bitcoin hit reverse later in the day, a fall through the morning low $6,581.2 to $6,569 bringing the day’s first major support level at $6,527.13 into play.

Having managed to avoid $6,400 levels since last Monday’s rally, Bitcoin will likely continue to find plenty of support at $6,500 to avoid a more material pullback in the event of a broad based market sell-off, barring materially negative news hitting the wires.

FXEmpire

30 minutes ago

David