Gold breaks below $1700 trading to a low of $1667 before recovering

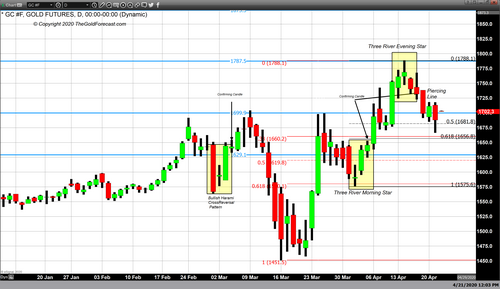

April 2020 has been a month that the majority of gold traders and investors will remember for some time to come. It is truly been a roller coaster ride, where gold traded to a low of $1575 on the first of the month, and within two weeks, on April 14 hit this year’s high at $1788 per ounce. After all that gold prices began to correct and within a week traded to the 61.8% Fibonacci retracement of this rally, this was today’s low of $1667.

The 61.8% Fibonacci retracement occurs at $1657, and last night’s trading activity took June futures pricing just $11 above of that price point. Although gold pricing recovered through the latter part of the trading session in New York, it still closed down by $13.70, and is fixed at $1697.50.

Yesterday we spoke about a two-day pattern called a piercing line. Although this Japanese candlestick pattern is a bullish reversal it requires a confirming candle. As we spoke about in our opening letter yesterday, “There is one other critical parameter that you would want to see in the upcoming days, the most important of which is a confirming candle. This means that tomorrow’s trading range will contain a higher high, a higher low than the previous day. Also, it must result as a green candle with the closing price well above the opening price. The bigger the confirming candles body sizes the more it confirms the piercing line pattern.”

Last night for a brief instance the market did in fact go into positive territory with gains on the day, but that was short-lived at best. Although it appeared as though we would see a confirming candle unfold, that was not to be the case.

Analysts are all over the board when it comes to their assessment of gold pricing in the future. They vary from Bank of America’s call for “$3000 gold in the next 18 months”, and TD securities forecasting that gold will “rise to $1900 per ounce in the next three months”. Two independent analysts at capital economics predicting that gold will hit $1600 partially due to deflationary pressures.

It is absolutely clear that there is not a unified or clear consensus as to where gold pricing will go in the future.

The truth of the matter is that we are in uncharted territory, and facing a crisis that the world was unprepared for. The COVID-19 virus has devastated global economies for the last month as it has put most countries citizens into isolation. This of course has caused the economy to dramatically contract, as evident in crude oil prices collapsing, with crude oil futures turning negative for the first time in history yesterday.

However, one thing is clear, and that is the unprecedented and immense stimulus which is been allocated by central banks globally. All things being equal the monetary policies of central banks around the world will devalue currencies, and as such be supportive of gold prices at some point.

David