Hawkish central banks will test gold bulls' resolve into year-end

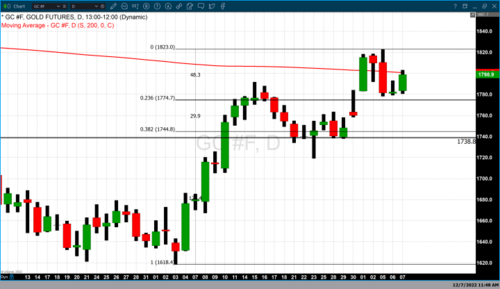

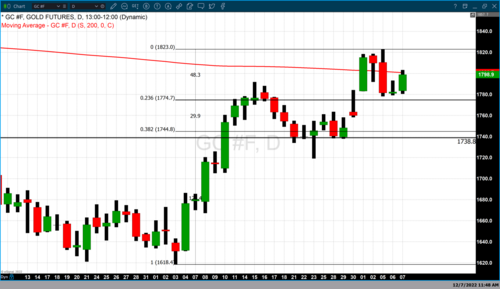

he gold market is holding its ground at around $1,800 an ounce despite growing hawkish rhetoric from central banks around the world; the bullish sentiment in the marketplace is pointing to a positive end for the precious metal for 2022.

The latest Kitco News shows that retail investors are still significantly bullish on gold heading into the final full trading week of the year. At the same time, Wall Street analysts are slightly more cautious, with many saying that lower gold prices represent a strategic buying opportunity.

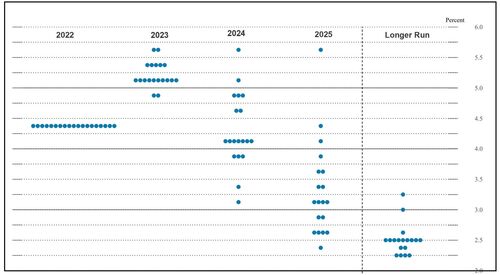

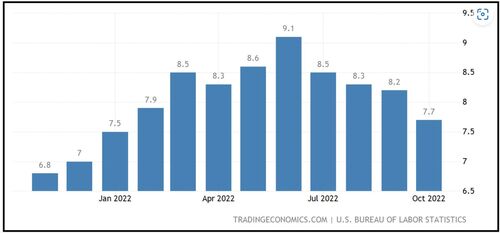

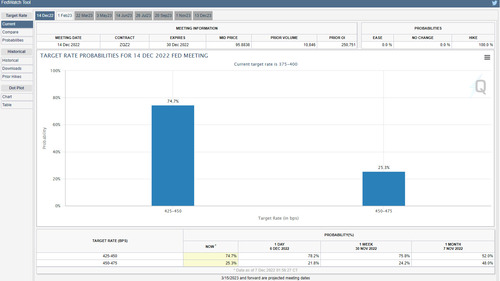

Although the Federal Reserve has signaled that it is nowhere near ready to halt its tightening cycle, analysts note that the market is starting to discount the hawkish stance. Some analysts have said that investors are now shifting their focus to the growing recession fears and away from the inflation threat.

"The Fed is not pumping the breaks just yet, but it is taking its foot off the gas, and that should help gold consolidate around $1,800," said Frank Cholly, senior market strategist at RJO Futures.

Christopher Vecchio, head of futures and forex at Tastylive.com, said that weaker economic growth is helping to bring down real yields, which continues to support gold around $1,800 an ounce.

"I think gold right now is well positioned to start the new year on a strong note," he said.

This week, 20 Wall Street analysts participated in the Kitco News Gold Survey. Among the participants, nine analysts, or 45%, were bullish on gold in the near term. At the same time, five analysts, or 25%, were bearish for next week and six analysts, or 30%, saw prices trading sideways.

Meanwhile, 772 votes were cast in an online Main Street poll. Of these, 437 respondents, or 57%, looked for gold to rise next week. Another 202, or 26%, said it would be lower, while 133 voters, or 17%, were neutral in the near term.

oic

The gold market is looking to end the week in roughly neutral territory, with prices down 0.5% from last Friday. February gold futures last traded at $1,800 an ounce.

Adam Button, head of currency strategy at Forelive.com, said he expects to see lower prices next week as hawkish central bank comments could weigh on prices.

Not only is the Federal Reserve not done raising interest rates, but European Central Bank President Christine Lagarde warned investors that the ECB is expected to continue to raise interest rates by 50 basis points well into 2023.

However, Button added that any dip in the price could be a buying opportunity as this is seasonally a strong period for gold.

"Even holding steady for the remainder of the month would be a win and set up gold for a nice rally in January," he said.

While gold has remained resilient as central banks tighten monetary policies worldwide, some analysts have noted that bullish momentum is starting to weigh as resistance holds around $1,800 an ounce.

pic

Downside risks for gold and silver prices in 2023 – Natixis' Dahdah

"The momentum indicators have not recovered. I still think a bigger pullback may be coming, but so far [gold has been] more resilient than I thought," said Marc Chandler, managing director at Bannockburn Global Forex. "This seems to be corresponding to a U.S. dollar, which seems better offered into rallies than bought on dips."

Darin Newsom, senior market analyst at Barchart, said that he sees the U.S. dollar entering a short-term uptrend helping to push gold prices lower.

"Last week's call for a lower market is still working, unless Feb gold posts a strong rally to close out Friday. If it doesn't, then the contract will have completed a bearish spike reversal on its weekly chart, confirming the secondary (intermediate-term) trend has turned down," he said.

By Neils Christensen

For Kitco News

David

The ECB's aggressive monetary policy stance gives gold a lifeline as euro makes a move against U.S. dollar

The ECB's aggressive monetary policy stance gives gold a lifeline as euro makes a move against U.S. dollar

Deutsche Bank wants back in the gold market after eight-year absence

Deutsche Bank wants back in the gold market after eight-year absence.gif)

Outlook 2023 LIVE with Gareth Soloway

Outlook 2023 LIVE with Gareth Soloway

.png)

.png)

.gif) JPMorgan, HSBC to share custody of GLD's 900 tonnes of gold

JPMorgan, HSBC to share custody of GLD's 900 tonnes of gold.gif)

.gif) Bitcoin price dips below $17K as recession fears rise to the surface

Bitcoin price dips below $17K as recession fears rise to the surface