Gold, silver gain on ideas of better future demand from China

Gold and silver prices are higher in midday U.S. trading Tuesday, but down from daily highs as the U.S. dollar index has rebounded from solid early losses. Falling U.S. Treasury yields on this day are supporting the precious metals markets. Some potentially positive news coming out of China is also working in favor of the metals market bulls. December gold was last up $8.00 at $1,648.50 and December silver was up $0.556 at $19.67.

Global stock and commodity markets were buoyed today by upbeat reports coming out of China. China stock markets rallied Tuesday on rumors the Chinese government has a plan to phase out its "zero covid" policies by as soon as March. China stock prices did back off their highs on reports Foreign Minister Zhao Lijian said he is not aware of the matter. China is the world's second-largest economy and if it gets rolling again, such would be significantly bullish on the demand front for commodities, including gold and silver.

Global stock markets were mostly firmer overnight. U.S. stock indexes are lower at midday on profit taking. Stock traders are done with the historically rocky months of September and October, after having a very good October, with near-term price uptrends in place on the daily charts for the indexes.

In other overnight news, Australia's central bank raised one of its main interest rates by 0.25%.

The World Gold Council has reportedly seen substantial, unreported buying of the yellow metal, as central bank bullion purchases hit a record in the third quarter. Reports said 400 metric tons of gold were bought by central banks last quarter, pushing purchases up to their highest since 1967. "Meantime, ETF selling amid soaring U.S. real yields has pushed gold prices lower, while central bankers have been meeting depressed prices with open arms," said broker SP Angel in an email dispatch Tuesday morning. The WGC reports Turkey and Qatar both ramped up purchases, with China and Russia also expected to be partaking, although their purchases are not reported, said the broker.

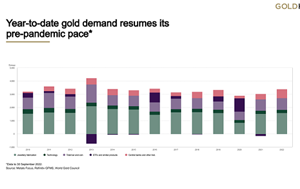

Gold demand hits pre-pandemic levels, increasing 28% in the third quarter despite dismal investor interest – World Gold Council

Traders are looking ahead to the Federal Reserve's Open Market Committee (FOMC) meeting that begins Tuesday morning and ends Wednesday afternoon with a statement and a press conference from Fed Chairman Jerome Powell. Most expect the FOMC to raise the Fed funds rate by another 0.75%. Traders and investors also want to see what comments the FOMC and Powell make regarding the future path of U.S. monetary policy—specifically, when the Fed will back off the accelerator on aggressively raising interest rates.

The key outside markets today see the U.S. dollar index slightly up. Nymex crude oil prices are higher and trading around $88.25 a barrel. The 10-year U.S. Treasury note is yielding 4.044%.

.gif)

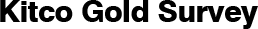

Technically, the gold futures bears have the solid overall near-term technical advantage. Prices are still in a longer-term downtrend on the daily bar chart. Bulls' next upside price objective is to produce a close above solid resistance at $1,700.00. Bears' next near-term downside price objective is pushing futures prices below solid technical support at $1,600.00. First resistance is seen at today's high of $1,660.30 and then at $1,670.90. First support is seen at today's low of $1,633.60 and then at the October low of $1,641.20. Wyckoff's Market Rating: 2.5.

December silver futures prices hit a three-week high today. The silver bulls have gained the slight overall near-term technical advantage. Prices are now in a two-month-old uptrend on the daily bar chart. Silver bulls' next upside price objective is closing prices above solid technical resistance at the October high of $21.31. The next downside price objective for the bears is closing prices below solid support at $18.00. First resistance is seen at today's high of $20.04 and then at $20.50. Next support is seen at $19.50 and then at today's low of $19.085. Wyckoff's Market Rating: 5.5.

December N.Y. copper closed up 980 points at 347.30 cents today. Prices closed nearer the session high today. The copper bears still have the overall near-term technical advantage. However, recent price action suggests a market bottom is in place. Copper bulls' next upside price objective is pushing and closing prices above solid technical resistance at the September high of 369.25 cents. The next downside price objective for the bears is closing prices below solid technical support at the September low of 324.30 cents. First resistance is seen at today's high of 350.15 cents and then at the October high of 359.30 cents. First support is seen at this week's low of 336.15 and then at the October low of 330.30 cents. Wyckoff's Market Rating: 4.0.

By Jim Wyckoff

For Kitco News

Time to buy Gold and Silver on the dips

David

.gif)

.png)

.gif) World Bank sees gold prices falling another 4% in 2023

World Bank sees gold prices falling another 4% in 2023

.jpg)

.jpg)

LBMA delegates see silver prices rallying 54% in the next 12 months

LBMA delegates see silver prices rallying 54% in the next 12 months