Gold recovers early losses as U.S. stock market melts down

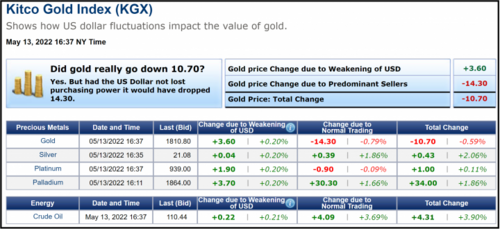

Gold prices are up a bit at midday Wednesday. The yellow metal recovered moderate early losses as some safe-haven demand surfaced amid a big sell off in the U.S. stock market at mid-week. June gold futures were last up $1.40 at $1,820.50. July Comex silver futures were last down $0.11 at $21.64 an ounce.

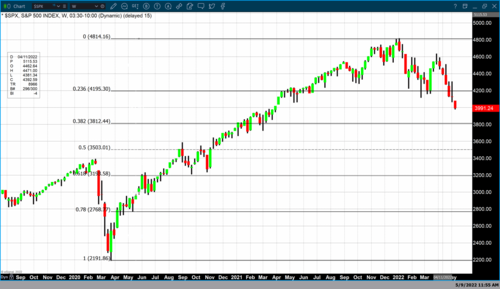

Global stock markets were mixed overnight. U.S. stock indexes are sharply lower on corrective pullbacks following gains on Tuesday. A big earnings miss from Target help sink the stock market at mid-week. Traders and investors are also tentative on new reports that Covid continues to spread in China, after reports earlier this week that said China's government could ease up on its lockdowns.

Federal Reserve Chairman Jerome Powell on Tuesday afternoon reiterated the central bank's main goal is to tamp down inflation, even if it means pushing up the unemployment rate. He said the Fed "has the tools and resolve" to cool inflation. The marketplace read his latest comments as maybe not surprising but certainly hawkish.

2022's $1 trillion crypto wipeout: 'necessary cleansing' of excess speculation just like dot-com bubble – Bloomberg Intelligence

2022's $1 trillion crypto wipeout: 'necessary cleansing' of excess speculation just like dot-com bubble – Bloomberg Intelligence

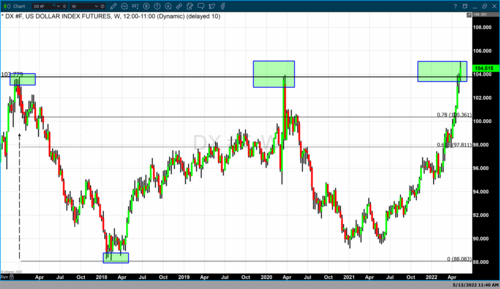

The key outside markets today see Nymex crude oil futures prices lower and trading around $110.00 a barrel. Meantime, the U.S. dollar index is higher in midday trading. The yield on the 10-year U.S. Treasury note is fetching around 2.9%.

.gif)

Technically, June gold futures see a nine-week-old price downtrend in place on the daily bar chart. Bears have the solid overall near-term technical advantage. Bulls' next upside price objective is to produce a close above solid resistance at $1,875.00. Bears' next near-term downside price objective is pushing futures prices below solid technical support at $1,750.00. First resistance is seen at this week's high of $1,834.80 and then at $1,850.00. First support is seen at today's low of $1,805.00 and then at $1,800.00. Wyckoff's Market Rating: 3.0.

.gif)

July silver futures see a steep price downtrend in place on the daily bar chart. The silver bears have the solid overall near-term technical advantage. Silver bulls' next upside price objective is closing prices above solid technical resistance at $23.00 an ounce. The next downside price objective for the bears is closing prices below solid support at $20.00. First resistance is seen at this week's high of $21.925 and then at $22.00. Next support is seen at today's low of $21.38 and then at $21.00. Wyckoff's Market Rating: 2.0.

July N.Y. copper closed down 550 points at 418.25 cents today. Prices closed nearer the session low today. The copper bears have the solid overall near-term technical advantage. A price downtrend is still in place on the daily bar chart. Copper bulls' next upside price objective is pushing and closing prices above solid technical resistance at 445.00 cents. The next downside price objective for the bears is closing prices below solid technical support at 400.00 cents. First resistance is seen at today's high of 424.80 cents this week's high of 428.25 cents. First support is seen at today's low of 416.10 cents and then at this week's low of 413.35 cents. Wyckoff's Market Rating: 2.0.

By Jim Wyckoff

For Kitco News

Time to buy Gold and Silver on the dips

David

.gif) Gold faces new competition as real yields turn positive – USBWM

Gold faces new competition as real yields turn positive – USBWM.gif)

.gif)

.jpg) U.S. dollar could dominate gold price through the summer – analysts

U.S. dollar could dominate gold price through the summer – analysts.gif)

.gif)

.jpg) Gold price is manipulated by the Fed, suspects mining tycoon Frank Giustra, but suppression can't last forever

Gold price is manipulated by the Fed, suspects mining tycoon Frank Giustra, but suppression can't last forever

Nothing can fix inflation now, 'economic stupidity' is underway by the Fed, Biden – Steve Hanke

Nothing can fix inflation now, 'economic stupidity' is underway by the Fed, Biden – Steve Hanke.gif)

.gif)

Gold price is manipulated by the Fed, suspects mining tycoon Frank Giustra, but suppression can't last forever

Gold price is manipulated by the Fed, suspects mining tycoon Frank Giustra, but suppression can't last forever