Gold riding the momentum wave to an eight-month high

Geopolitical uncertainty continues to dominate market sentiment, and gold has been able to ride this new wave of fear and momentum to an eight-month high of $1,900 an ounce.

Despite gold's 3% rally this week, the question remains: can the precious metal hold on to this momentum if and when tensions between the U.S. and Russia start to ease. As I have mentioned before, this is one of the reasons why I have never been a fan of buying gold as a safe-haven asset.

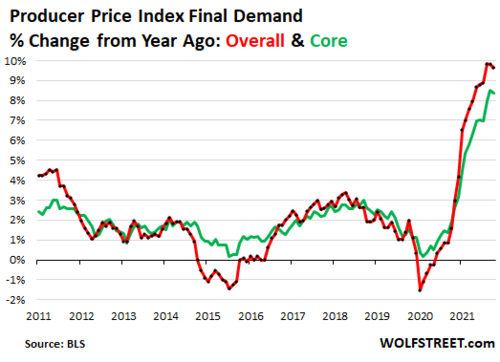

However, I have also noted that this time feels slightly different as inflation remains a dark cloud hovering over markets and exacting its toll on the global economy. As central banks worldwide react to rising consumer prices, many analysts are starting to ring the warning bell that monetary policy tightening could push the global economy into a recession.

Friday, Bank of America's chief investment strategist, Michael Hartnett, said in his latest note that "recession risks [are] rising." He said that he sees a scenario where over the next six months, "rates shock morphs into recession shock."

We are approaching the time when gold will shine. At some point, markets will realize that their monetary policy expectations have been too aggressive.

We are already starting to see expectations of an aggressive move in March being pared back. At the start of the week, markets saw a more than 50% chance of a 50-basis point hike. Markets now see a 30% chance of that happening.

What's next for gold price? Geopolitics shock markets, growth outlook at riskFrom the minutes of the Federal Reserve's January monetary policy meeting, we can see that the central bank wants to raise interest rates "soon." Ultimately, they will not sacrifice economic growth to rein in inflation.

When markets understand this fundamental truth, they will realize that real rates will remain extremely low, and that is where gold's true value starts to shine.

According to many commodity analysts, a perfect storm is on the horizon as rising interest rates will add volatility to equity markets, forcing investors to reduce their risk profiles.

However, in a world of still low interest rates, bond yields don't provide the protection they once did.

This week I had a chance to talk with John Reade, chief market strategist at the World Gold Council, and I asked him why investors should be paying more attention to gold. He noted that gold could be an important diversification tool for any portfolio or investor.

"We've issued various editions of the strategic case for gold in the U.K. and Europe and Australia, Russia, Singapore. Looking at the benchmark of assets that might be in a typical portfolio for each of those countries, you find very similar result," he said. "Somewhere between 4% and maybe the higher 10%, of gold in your portfolio seems to be optimal for increasing the risk-adjusted returns," he said.

It's also more than just gold that is benefiting. In an interview with Kitco News, Morgan Lekstrom, president and CEO of Silver Hammer Mining Corp, said that as gold starts to move higher, silver should start to shine.

We have also seen sharp moves higher in platinum and palladium as gold prices have rallied.

Have a great weekend

By Neils Christensen

For Kitco News

Time to buy Gold and Silver on the dips

David

.gif)

.gif)