Outlook 2020 – The Big Picture Backdrop for Precious Metals

The year ahead promises to be an eventful one. It will, of course, be dominated by political headlines leading up to the 2020 election. It could also be a big breakout year for precious metals.

In the second part of Money Metals' 2020 Outlook, we’ll drill down on the fundamental and technical setup for gold and silver…

However, in this first part, we’ll set the stage by digging into the macro forces at play in the economy, monetary policy, politics, and geopolitics.

Economy

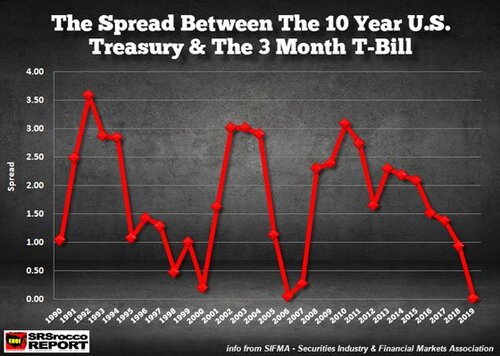

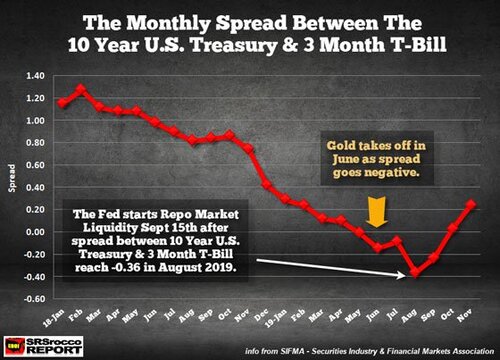

Over the summer, the mainstream financial media ran hard with the “recession” angle. A manufacturing slowdown seemed to be afoot. But the main impetus for all the recession talk was an inversion of the yield curve – putting short-term bond yields below those of longer-term bonds.

Democrats were nearly gleeful at the prospect of a recession. But such thinking proved to be premature.

The economy does not appear to be headed into recession as we begin 2020. Official employment numbers continue to come in historically strong. And GDP growth, though modest at 2.1% as of Q3, is still indicating an overall expansion.

As for the yield curve inversion, the Fed got the message and drove short-term rates back below long-term rates. The inversion still serves as a possible precursor to a recession, but it may not actually hit until 2021 or later.

Continued global economic growth in 2020 could drive a late-cycle bull market in commodities, including the metals complex.

Leading up to a recession, the energy and materials sectors tend to outperform the broad market before rolling over. Gold and silver tend to peak later, with gold often rising counter-cyclically to economically sensitive assets.

Monetary Policy

In 2019, the Federal Reserve did a dramatic about-face on interest rates. Instead of hiking, as was widely expected by mainstream forecasters, the Fed paused… then cut rates three times.

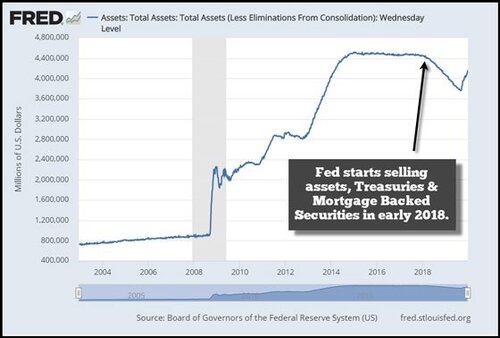

By the fall, it was engaging in massive interventions to prop up the repo market and launching what is effectively a new Quantitative Easing program.

Nobody in the financial “mainstream” saw that coming at the beginning of the year!

The Fed is now back on pause for an unknown period. At his latest press conference Fed Chairman Jerome Powell indicated he would like to a see a significant and sustained rise in inflation before hiking rates again.

Higher inflation coupled with accommodative monetary policy would potentially be rocket fuel for precious metals markets.

A weaker Federal Reserve Note “dollar” versus foreign currencies isn’t necessary for hard assets to gain, but it certainly wouldn’t hurt. The U.S. Dollar Index peaked for 2019 in late September after a modest run-up. It has since retraced and will finish the year nearly flat.

The dollar has fallen in the fourth quarter along with the QE surge in the Fed’s balance sheet. The central bank’s net asset purchases are up by $400 billion already. Its balance sheet will likely rise to an all-time record by spring 2020, further cheapening the real value of the Federal Reserve Note in the process.

Politics

There is no shortage of opinion on who will, and who should, win the 2020 election. But we’ll stay out of the political “horse race” debate that fills the airtime on all of the cable news channels hour after hour, day after day.

We note only that political prediction markets currently give the upper hand to President Donald Trump. As long as the economy doesn’t dip into recession, the smart money seems to be on Trump to triumph over a weak Democrat field.

Should the economy falter or Trump get bogged down in a new controversy that erodes his support, the political dynamics could shift – and potentially roil markets.

Several outspoken billionaires – from Ray Dalio to Paul Tudor Jones to Stanley Druckenmiller to Leon Cooperman – have each warned that a Democrat victory over Trump could trigger a stock market meltdown (especially if the victorious Democrat is a Bernie Sanders or Elizabeth Warren-type anti-capitalist firebrand).

Such an event, in turn, would enhance the safe-haven appeal of precious metals.

So far during the Trump presidency, “fear trade” demand for physical precious metals has been mostly muted. The metals have made modest gains based on other factors. But before we see truly spectacular gains in gold and silver, we will likely need some sort of economic, political, or geopolitical black swan event to shake investors out of their complacency.

Geopolitics

The big geopolitical story of 2019 was the trade standoff between the United States and China. Every week, seemingly, brought us either one step closer or one step further behind a trade deal.

Much – perhaps too much – was made of the impact of trade wars on market trends. But a favorable outcome in 2020 would certainly go toward boosting manufacturing activity and demand for industrial metals.

Other geopolitical threats loom in 2020 as well.

As the U.S. continues to ramp up economic sanctions on Russia, the Russians continue to look for ways to retaliate. One if its long-term strategic aims is to secure international trade deals outside the Federal Reserve Note dollar system. It is finding willing partners in U.S. adversaries who have been hit or threatened with sanctions.

The U.S. has shown in the past that it is willing to go to war to defend its fiat dollar.

A possible war with Iran, North Korea, Russia, or China – or a shutdown of oil production from the Middle East – would be extremely disruptive to markets and could send safe-haven demand for precious metals skyrocketing.

Barring an unforeseen black swan event or crisis, the big picture backdrop for precious metals looks constructive for another year of significant but not necessarily spectacular gains.

At some point, though, whether next year or in future years, mounting risks will propel gold and silver higher with explosive force.

by: Stefan Gleason

Money Metals News Service

December 31st, 2019

David

.jpg)