ECB-Fed divergence and political upheaval could roil currencies and boost gold, analysts warn

The European Central Bank (ECB) will issue its interest rate decision on Thursday morning, and while markets are not predicting any change to the rate at the April meeting, expectations are ramping up for them to kick off the cutting cycle soon.

But across the pond in the United States, a stronger-than-expected economy coupled with higher-than-expected inflation readings are pushing the prospect of rate cuts from the Federal Reserve further into the future.

Could the world’s two most influential central banks be on the verge of a divergence in interest rate policy? And if so, what are the implications for the euro, the dollar, and gold?

Marc Chandler, Managing Director at Bannockburn Global Forex, said that after last week’s softer-than-expected Eurozone CPI data, market participants see only a 10% chance of a rate cut at Thursday’s ECB meeting, but they now feel fairly confident of a June rate cut. “It's nearly fully discounted for June,” he said.

By contrast, Chandler said things appear to be moving in the opposite direction in the United States. “The futures market has not only moved away from the June Fed cut, which is around 50 percent or so now, but they've also downgraded the chances of a July cut,” he said. “For the first time since October last year, the market's not pricing in at least 25 basis points by July.”

Adam Button, Head of Currency Strategy at Forexlive.com, believes the ECB and the Fed are in very different positions, as the former faces political pressures and a popular reckoning in the near term.

“It's that generational aversion to inflation, and I think it's that political anger too,” Button said. “We have it everywhere in the world, the political anger about inflation, and you don't want that to be redirected at you if you're the central bank. This is their job.”

“I think the ECB is likely to embark on a consistent rate-cutting cycle, where the Fed may just dip in its toes.”

Chandler said that in the near term, he wouldn’t characterize the ECB starting its easing as a divergence from the Fed, but more of a head start down the same path. “I don't know how much of it is divergence and how much of it is just sequencing,” he said, noting that FOMC members including Powell and the Fed’s latest dot plots all point to multiple rate cuts at some point this year. “We're talking about sequentially, that the ECB might cut rates say, one or two months before the Fed.”

Chandler said he believes this is one of the factors that has weighed on the euro against the U.S. dollar, though it has shown resilience. “The euro last month, as this was beginning to be discounted, held the February low, which is around 107,” he pointed out.

European, U.S. growth closer than appearances

But Chandler said he doesn’t think the United States’ stronger economic performance is really a case of U.S. exceptionalism. “I think that the stronger growth in the U.S. can be accounted for by a budget deficit that's roughly twice the level of the Eurozone,” he said. “And I think that Europe has also been hit still with the disruption of Russia's invasion of Ukraine, and that has kept the energy prices in Europe higher than they are in the U.S. What we're seeing is the manufacturing sector in the Eurozone, especially in France and Germany, is still under pressure. The periphery, like Spain and Italy, ironically, are doing better.”

Button also sees much of the United States’ purported growth as a mirage. “They're running huge deficits,” he said. “That’s the big difference between Europe and the U.S. Europe isn't spending right now, the budget rules are pretty strict there, and the U.S. is spending massively. That might explain maybe half the difference in growth between Europe and the U.S.”

Chandler said that rising salaries in the United States, which are a problem in terms of inflation, are also a boon for growth data. “In the U.S., we've seen real wage increases, wages growing faster than inflation,” he said. “And that helps the consumer sector, which, as we know from recent data, including the Q4 data, continues to be a bright spot for the U.S. economy.”

Chandler pointed out that Fed Chair Jerome Powell frequently asserts that they need to see better inflation data to be more confident before cutting rates, and recent data is having the opposite effect. “The Fed says ‘we're data dependent,’ and the market takes a look at data and says, ‘Okay, it's going to take you a little bit longer to cut rates.’”

“Part of the problem is that the market's been talking about recessions for a couple of years now, and with the resilience of the U. S. economy, I think it's finally hitting them,” he said. “But to me, this is a contrarian indicator. Many economists have been talking about a recession for a couple of years, we don't get it, and now that the market capitulates and says, ‘Well, maybe the Fed's not going to have to cut rates as much as they thought,’ I think that's when the economy begins weakening.”

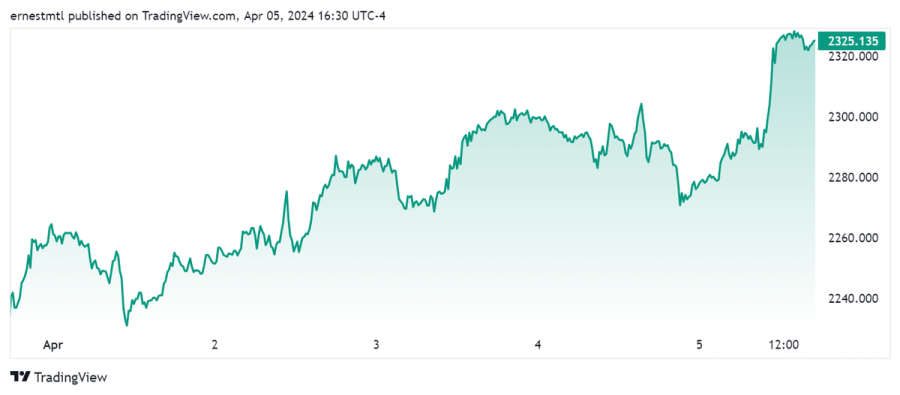

Chandler said that he expects Q1 growth to remain strong and noted that the Atlanta Fed GDP tracker is predicting a healthy 2. 8%, but that the coming months will bring the anticipated downturn on the back of “the accumulation of the financial tightening, the higher interest rates, the slowdown in credit extension, some deterioration below the surface in the full-time jobs group, for example.”

“What it really is, is a question of timing,” Chandler said. “Timing these things is very difficult, but getting the general direction, getting the pattern… I think the market once again postpones the downturn to the second half of the year.”

“One of the incredible things about the market is it’s an anticipatory mechanism,” he added. “Part of the reason why the euro is still under pressure is that the market's pricing exactly that scenario in.”

Button said the central banks’ policies could still look similar in the near term, but things are set to change in the coming years. “Say the Fed cuts 50 or 75 and ECB maybe about that,” he said. “It's in 2025 when the ECB will have that latitude to keep on cutting rates and the Fed might not. I think that's when you see that divergence open up. 2026 is when the U.S. really starts to stumble because that's when the IRA [Inflation Reduction Act] and the [CHIPS and Science Act] run out.”

But in the near term, if the ECB eases before the Fed, it could have real implications for their respective currencies, and for gold.

Chandler said that while much of the euro’s expected weakening in this scenario is priced in, there’s still a late move from the broader public. “There's a difference between institutional and retail investors,” he said. “I think oftentimes retail investors have other things on their plate, they're working, they've got family, and they wait for the news to come out. The news says ‘ECB cut rates, the Fed is not going to.’ And then they might decide to sell the euro. Meanwhile, institutional investors are anticipating these things. They're looking at the same things we are, like the swaps market, the futures market.”

Chandler said this can be clearly seen in the difference between the two-year yields on both sides of the pond. “The U.S. premium fell to about 165 basis points over Germany back in January, now it's at 190 basis points,” he said. “I think that's what's weighing on the euro.”

“What happens then is, say we get to June, the ECB cuts, the Fed doesn't and some traders, especially retail investors, say ‘oh, this is a policy divergence’ and they sell the euro. Meanwhile, the institutional investors which are already short the euro, buy it back because they think, now that the ECB has cut, what's the next move? The next move is going to be the Fed cut.”

Will Europeans get into gold?

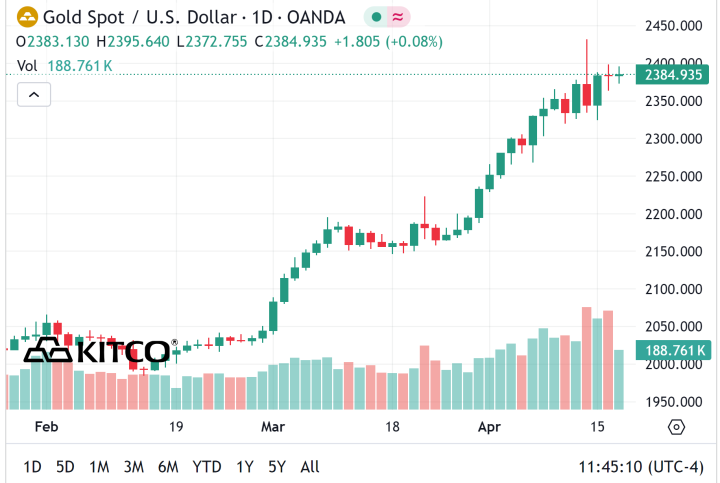

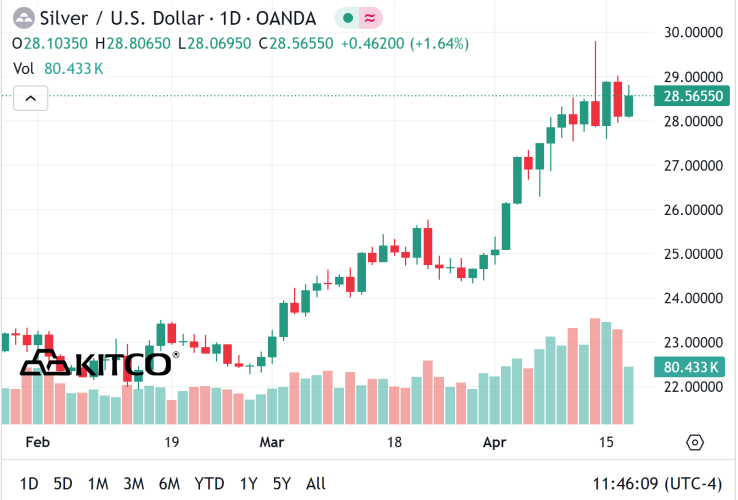

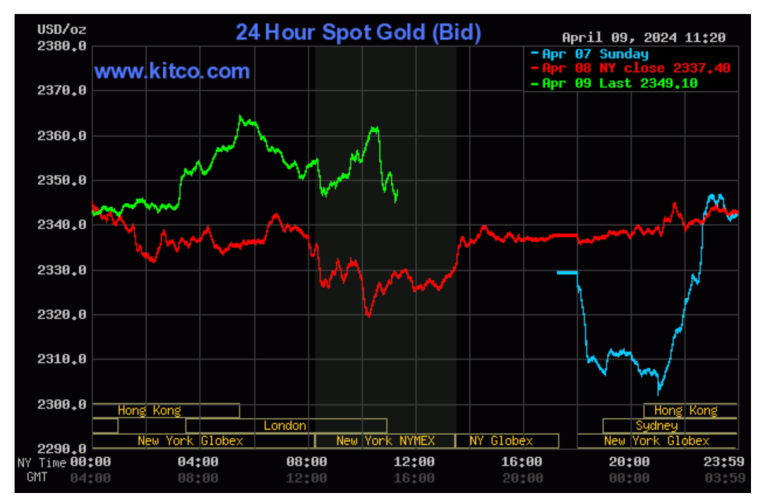

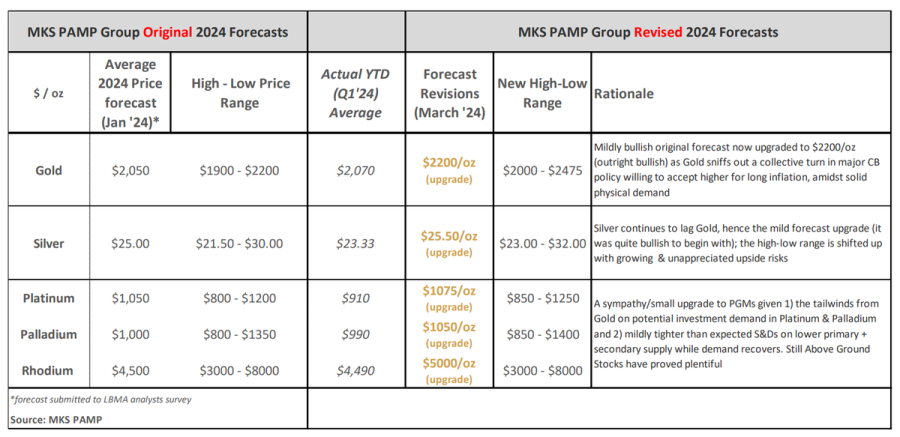

Button also believes that the euro will come under pressure in the near term. “The question is whether Europeans turn to gold as a store of value,” he said. “At the margins, I think that could happen. This year, gold looks great in euros, and it's certainly not loved right now, so there is room for money to flow into gold there. But then you can also argue that if the dollar strengthens, a strong dollar isn't always great for gold.”

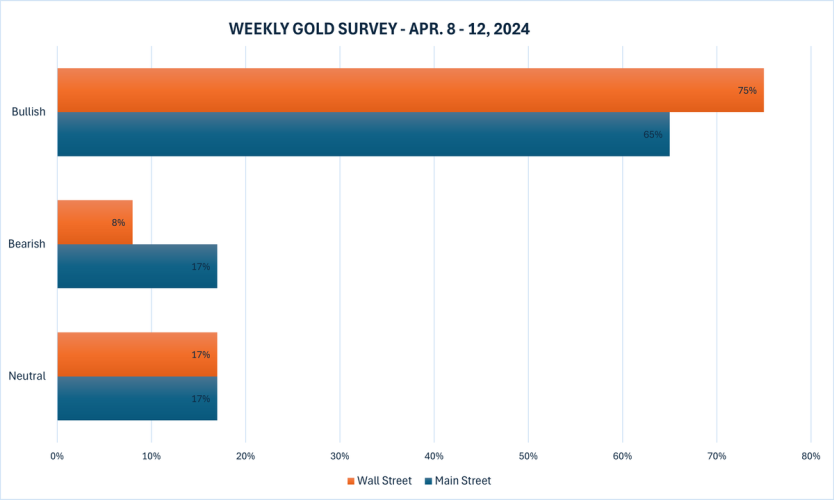

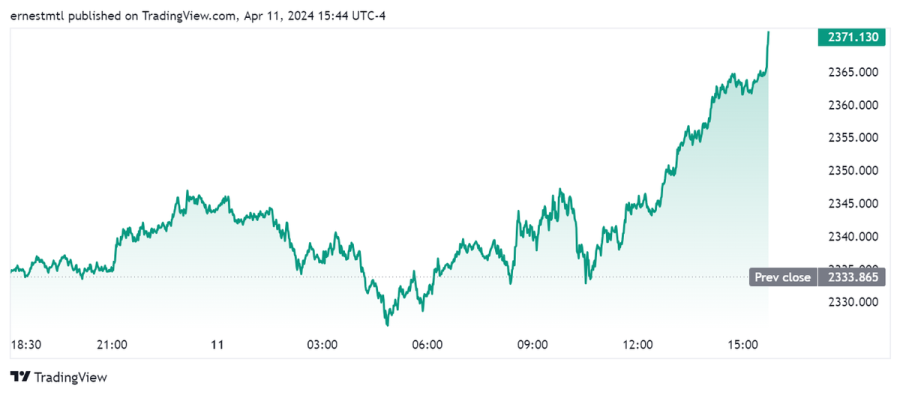

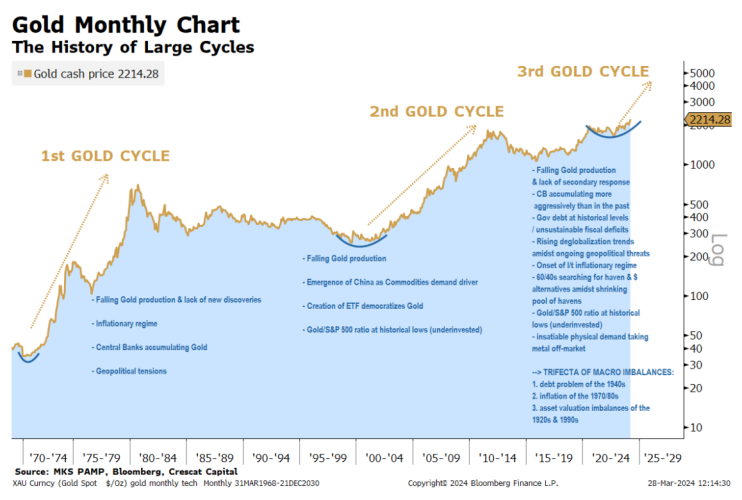

Still, he expects that if the broader European public finds itself “gripped by the feeling of a falling currency,” this would be “a natural driver” for gold. “I assume that 90, 95 percent of those real money flows go into other currencies, but that five percent is significant in a market like gold,” Button said. “Right now, gold is positioning itself as strong and I think that has a long way to run. The more good days that gold has, it's a snowball running downhill.”

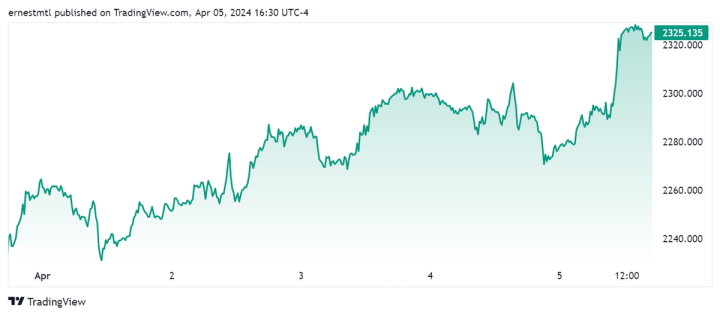

“In all markets right now, the winners keep on winning and we’re in the most liquid time in history, the easiest time to trade in history,” he added. “So long as gold continues to rise, the money will find its way into gold. When Europe weakens, people look at gold. Maybe it's hard to buy the all-time highs. But since we broke out about $2100, what's the biggest dip? 30, 40 dollars? I think that's the best you're going to get.”

For his part, Chandler doesn’t see much chance of European investors piling into gold the way many Asian investors have, because the dynamics are very different.

“I was just looking at European bank shares, and they're doing great,” he said. “Japanese banks have done fairly well too, especially now that [the Bank of Japan] has raised interest rates. I think that for the same reasons that Americans don't own a lot of gold, I don't really expect Europe to buy a lot of gold.”

“I'm not sure that a rate cut from the ECB is a key catalyst,” he added. “I think that gold might rally, but I think gold's already rallying.”

Looking further out, Button does expect U.S. investors to pile into gold eventually, but when they do, it will be more of a greed trade than a fear trade.

“That's the exorbitant privilege of the U.S. dollar, is that Americans don't think about moving money into euros,” he said. “The Europeans do fret about the euro and fret about currencies. They have a long memory of domestic currency weakness, so they look for alternatives in the FX and the gold space, maybe crypto, when that weakness starts, whereas Americans are more inclined to look to gold.”

“When the dollar does eventually turn, Americans are buying.”

Button said that what needs to happen in the United States is for gold to capture the imagination of investors. “Once a market grabs the attention of the investing community right now, the moves can be phenomenal,” he said. “In a way, gold has already made an incredible move, but it hasn't quite got the attention yet. If gold and precious metals can recapture investor imagination like they did in the early 2000s, then you can't overstate the upside.”

“There's so much more money in capital markets than there was 15 years ago when that big gold bull market happened,” Button added. “Layer on leverage and options, and I think there's an opportunity to dream big. I don't know if it's the Fed cutting that kicks that off, or Asia, but I think price is the only thing that really matters and there's no need to risk overthinking it.”

Button pointed out that the environment of the past year has been terrible for gold, with high rates, every other market doing well, and crypto taking off. “And yet gold is at record highs,” he said. “I look at gold as a market that's taken the fundamentals’ worst punch.”

Continental shift could shake markets

Chandler said that the other major driver behind a potential divergence between the United States and Europe is the tectonic shift in the latter’s political landscape, which creates risks for currencies and commodities like gold. “There are European parliamentary elections in June,” he said. “And these polls show the current leadership in France and Germany with very low levels of support, which warns of a shift to the right.”

Button agreed that politics is the wild card on the continent, and it’s likely to impact markets in unforeseen ways. “Political changes is coming, and that could be the trigger for some kind of fear, uncertainty trade,” he said. “There was a brief period around COVID where the ideological cohesion in Europe was unprecedented. That fragmented quickly, and it will continue to fragment, I'm sure of it.”

“That is probably your best case for gold buying in Europe, and it's a pretty strong one,” Button said. “That's where I’d be watching, because I don't know if there's an incumbent party in Europe that's safe right now.”

“It won't surprise me to see further gains in gold,” said Chandler. “I'm not sure that the Chinese situation changes very much. I'm not sure the Turkish situation changes very much. For me, it's a really a story of what's going to change those forces. And I don't I don't see that on the horizon.”

Kitco Media

Ernest Hoffman

Time to Buy Gold and Silver

David

.jpeg) The gold market is seeing solid selling pressure after failing to hold its ground at $2,400 an ounce. Although the market has room to fall lower during the summer, one market analyst says that the precious metal remains in a solid position to rally by year-end.

The gold market is seeing solid selling pressure after failing to hold its ground at $2,400 an ounce. Although the market has room to fall lower during the summer, one market analyst says that the precious metal remains in a solid position to rally by year-end..png)

.png)

(2).jpeg)