What's next for gold price? Geopolitics shock markets, growth outlook at risk

Don't be surprised to see some exaggerated moves in gold as the market goes into a geopolitically-tensed long weekend, analysts told Kitco News. But the outlook for gold remains bullish as the precious metal tests $1,900 an ounce.

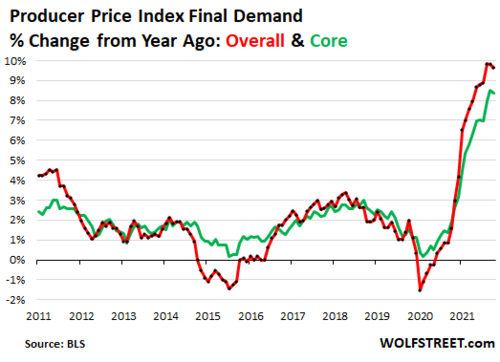

It has been chaotic trading in the stock market this week with piece-meal updates on the geopolitical situation in Ukraine keeping investors in a risk-off mood. Also, the repricing of the Federal Reserve's rate hikes to battle four-decade high inflation saw investors leave risky assets and embrace safe havens such as gold.

Russia's military exercises are scheduled to end on Sunday, with troops' movements being the key development being watched. Meanwhile, U.S. President Joe Biden remains convinced that Moscow is planning an "imminent invasion."

All eyes are on the U.S. Secretary of State Antony Blinken meeting with Russian Foreign Minister Sergei Lavrov in Europe next week.

"Right now, investors are having a hard time handling all of these geopolitical risks, headlines, and incremental updates. There is not going to be an immediate resolution on Ukraine's situation," OANDA senior market analyst Edward Moya told Kitco News.

On top of the geopolitical angle, the big gold driver is economic growth concerns due to aggressive tightening by central banks.

Countries are finally coming out of the pandemic, but they face very sticky inflation. This puts growth outlooks at risk, Moya pointed out. And what this geopolitical story has done is pour extra fuel onto the global energy crisis by accelerating supply chain issues, which could feed into more aggressive central bank tightening.

"In the end, it will hurt growth, and that should be supportive for gold. We will be talking about an inverted yield curve [often seen as a precursor to recession or depression] a lot sooner than anyone anticipated. The outlook on Wall Street is quickly shifting," he noted.

Many investors are becoming concerned about where the economy will be in 12-24 months as Wall Street talks recession.

"We are going to see there's this scrambling towards cash across many investors. Flight to safety is growing. Even if we have an extended period of uncertainty as far as what will happen in Ukraine, you will still see continued move into safety. That should benefit gold," Moya said.

The inflation argument makes gold look very appealing to investors who are fleeing the risky stocks and crypto market, said Phoenix Futures and Options LLC president Kevin Grady told Kitco News.

"A lot of the gold's price moves are coming from the inflation story. We see inflation hitting 7.5%, which is a 40-year high. But if we use the same metric to measure the consumer price index (CPI) as in 1980, our inflation would be closer to 15%. People are realizing this, which is why gold is finally rallying. The Fed has no handle on inflation, and the energy market is facing a lot of pressures from high demand," Grady said. "Everyone is waiting for this Federal Reserve meeting in March to see how the central bank will approach inflation."

Gold price hits $1,900 on mounting Russia-Ukraine tensions and recession fears

Gold price at $1,900

Gold tested the $1,900 an ounce level on Thursday, reaching the highest level since mid-June. At the time of writing, April Comex gold futures were trading at $1,899.10, up 3% on the week.

There is more upside potential for gold going into next week, Moya pointed out. "There are elevated risks going into the long weekend. Risk sentiment soured, and there is not much that could bring it back quickly," he said.

As far as support and resistance levels for gold, $1,930 is going to be the critical resistance level on the upside, according to Moya. On the downside, gold has support at $1,880. "Given the holiday on Monday, you should not be surprised to see some exaggerated swings at the open," he added.

Grady is watching two levels from the end of May as resistance points — $1,919 and $1,922 an ounce. There is a lot of overhead resistance above these levels, he noted. Short-term support for gold is at $1,881.60, which was the February 16 high. If that doesn't hold, gold could retreat to $1,845 an ounce.

There is a risk for a pullback in gold if geopolitical tensions deescalate, Grady warned, stating that investors already saw this being partly played out this week. "Last Friday, we saw stocks collapse and gold explode after the U.S. warning that Russia could attack Ukraine' any day'. Then on Monday, we had a reversal as tensions calmed down. And then the cycle was repeated once again," he said.

Next week's macro data

On the data front, markets will be eyeing Fed speakers after scaling back their expectations of a 50 basis point rate hike at the March meeting back to 33%, according to the CME FedWatch Tool.

"Next week's Fed speak agenda includes a few hawkish voices (Bostic, Mester and Waller), which could revamp speculation on rate-hike front-loading and further help put a floor under the dollar," said ING FX strategist Francesco Pesole.

Tuesday: Manufacturing PMI, CB consumer confidence, Federal Reserve Bank of Atlanta President Raphael Bostic speaks

Thursday: GDP Q4, initial jobless claims, new home sales, Federal Reserve Bank of Cleveland President Loretta Mester speaks

Friday: PCE price index, personal spending, durable goods orders

By Anna Golubova

For Kitco News

Time to buy Gold and Silver on the dips

David