Rally or selloff next week? Gold price is waiting for a catalyst and this could be it – analysts

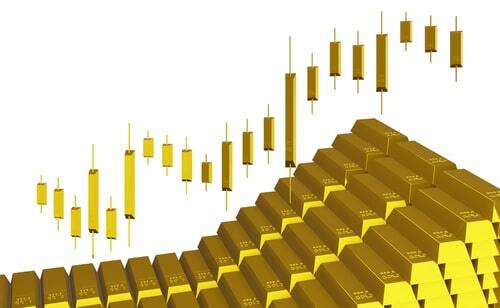

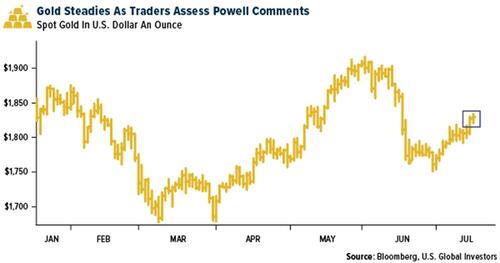

Gold has once again failed to break above the $1,800 an ounce level, but one looming driver can take the precious metal out of its trading range, according to analysts.

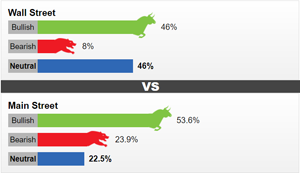

Many experts in the space are warning investors of a possible sell-off in U.S. equities, and it just might be what gold needs this fall.

Goldman Sachs Group, Morgan Stanley, Citigroup Inc. and Bank of America Corp. are all getting nervous about the U.S. stock market, stating that the valuations are getting extreme.

Deutsche Bank AG joined the other banks late this week with a message that there is a risk of a market correction, citing stock valuations that have risen to around 21 times earnings.

Volatility in the equity space might be what gold needs right now, said Bloomberg Intelligence senior commodity strategist Mike McGlone. "A constricting gold-price cage and gravity pull around $1,800 an ounce is akin to patterns that previously emerged just prior to returning to a more enduring upward trajectory. Newcomer digital reserve asset Bitcoin may be hindering the old analog, but we see both ripe to resume advancing. Some wobble in equities may act as a catalyst," he said.

Even a bit of uneasiness in the U.S. equity market could be enough to get the precious metal going, McGlone added.

"Just some reversion in the steepest gold discount to the S&P 500 since 2005 may indicate a spark to break the metal out of its bull-market cage. The gold-to-S&P 500 ratio has dipped below the extreme from about three years ago that broke gold away from the gravity pull around $1,270 an ounce toward its record high of about $2,075 in 2020. About $1,800 is the lock-in price since July 2020," he said. "When equities eventually revert a bit, gold stands to be a primary beneficiary, as we see it."

In light of this potential market volatility and considering gold's current trading levels, it is unlikely for the precious metal to see more sell-offs, said BMO Capital Markets managing director of commodities research Colin Hamilton.

"This is still a very good gold price. Despite falling ~6.5% year to date, gold prices have steadied around $1,800/oz, amid China's slowing economic growth, ongoing Delta-related restrictions and, for now, the latest Jackson Hole speech and August's nonfarm payroll miss assuaging fears of an early Fed tapering," Hamilton said. "With negative real yields, high geopolitical tensions and potential for wider market volatility, we see the potential for a sharp correction in gold (a la 2013) as relatively low."

In the meantime, however, gold continues to suffer a series of disappointments, including this week's reversal from the $1,830 an ounce level, said MKS PAMP GROUP head of metals strategy Nicky Shiels.

"Gold has simply been a correlation trade to interest rates and FX trends; it's a casualty to the USD/rates' path of least resistance in both being higher into a Fed taper," noted Shiels. "Gold continues to be unable to capitalize on structural themes (threat of persistent/runaway inflation, risk of a Fed policy mistake, unstainable U.S. debt trajectory, Bigger Gov, Bidens (plummeting) approval rating and/or trust in U.S. gov, the need/role real assets play in portfolios etc)."

Many analysts remain neutral in the short term, pointing out that gold will remain range-bound unless it can rise above $1,830 an ounce or drop below $1,800 an ounce.

"Over the next week, gold is anchored around $1,800. The story is not in the one-week horizon but probably in the three-month horizon. In this period of time, growth expectations will decline, and inflation expectations will remain. And it will be a good environment for gold," said TD Securities commodity strategist Daniel Ghali.

There is a lid on the gold market right now, partly because of the Federal Reserve tapering expectations, said RJO Futures senior market strategist Frank Cholly.

"We are still range-bound. The market has not been able to move above $1,825-$1,830. Right now, the gold traders don't like the idea of Fed tapering sooner rather than later. At some point, the Fed will need to begin to normalize rates. But both the equity and the gold markets have become dependent on the Fed to be there. That is the floor under the market. When we start to pull back and taper, both markets are not going to like it at first," Cholly said.

Plus, every time the U.S. dollar index rises above 93, gold struggles, Cholly added. "If the market doesn't get below $1,780 or above $1,830, I am neutral," he said.

But once the market realizes that inflation is here to stay, gold will have another chance at $2,00 an ounce, Cholly stated. "I am in the camp that believes inflation is here for the long-term and that it will get to the point that it will run away before Fed can reign it in. And at some point, gold will realize that and start to move higher up. This is when we could see a secondary rally above $2,000," he said.

Data to watch

All eyes will be on the U.S. CPI numbers out on Tuesday and the U.S. retail figures scheduled to be released on Thursday.

Other key data sets will include Wednesday's NY Empire State manufacturing index along with industrial production and Thursday's jobless claims with the Philadelphia Fed manufacturing index.

By Anna Golubova

For Kitco News

Kinesis Money the cheapest place to buy/sell Gold and Silver with Free secure storage

David

.jpg)