Gold bulls see potential for higher prices as inflation remains a threat

The gold market has started the new year on solid footing as prices look to end the week above $1,800 an ounce and short-term sentiment remains significantly bullish, according to the latest Kitco News Weekly Gold Survey.

According to some analysts, not only is gold seeing some renewed technical bullish momentum, but economic data highlighting rising inflation and weaker consumption and rising geopolitical uncertainty is providing some fundamental support for the precious metal.

However, other analysts have said that hawkish expectations that the Federal Reserve will aggressively raise interest rates will provide some support for the U.S. dollar, creating headwinds for gold.

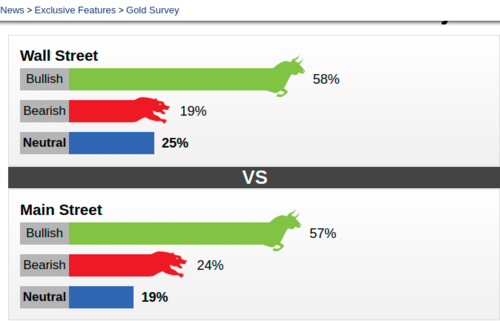

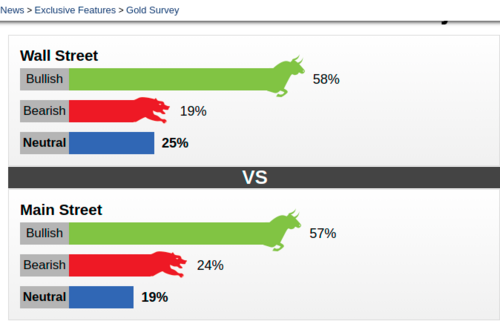

This week 16 Wall Street analysts participated in Kitco News' gold survey. Among the participants, nine analysts, or 58%, called for gold prices to rise next week. At the same time, three analysts, or 19%, were bearish on gold in the near term, and four analysts or 25% were neutral on prices.

Meanwhile, a total of 928 votes were cast in online Main Street polls. Of these, 529 respondents, or 57%, looked for gold to rise next week. Another 225, or 24%, said lower, while 174voters, or 19%, were neutral.

The bullish outlook comes as gold prices last traded around $1,816 an ounce, up 1% from the previous week.

For many analysts, inflation continues to provide the most support for gold through 2022. Tuesday, the U.S. Consumer Price Index showed annual inflation rising 7% in December, its highest level since June 1982.

"Overall, I see gold in a moderate uptrend propelled by high inflation, which remains stubbornly high and may continue to pick up with commodity prices on the rise again this week," said Colin Cieszynski, chief market strategist at SIA Wealth Management.

For other analysts, gold's ability to push back above $1,815 an ounce could attract more technical momentum in the near term.

"It's time for the metal to put the foot down and crash through the 1830-35 resistance area. Most of the hawkish news is priced in by now, which leaves the market much better balanced and receptive to potential price positive news, said Ole Hansen, head of commodity strategy at Saxo Bank.

First-rate hike, high inflation favors gold – WGC

Marc Chandler, managing director at Bannockburn Global Forex, said that growing market uncertainty could provide some support for gold in the near term as he looks prices to test resistance at $1,830 an ounce.

"The pendulum of market sentiment is swinging from the Fed is behind the curve of a booming economy with low unemployment to the Fed is going to kill the economy through rate hikes and balance sheet adjustments. Crypto is not proving to be a good hedge of inflation and remains volatile," he said. "The world looks a mess with Russia apparently about to take another piece of Ukraine and Biden's support is falling. Gold looks good if it can take out $1830."

However, not all analysts are optimistic on gold in the near term. Nicholas Frappell, global general manager at ABC Bullion, said that he is watching to see if the U.S. dollar can find some support after what has been a volatile week.

"The recent fall in the USD looks slightly overextended, and the gold price has not so far gotten past the 61.80 Fib barrier at US$1829,' he said.

Darin Newsom, president of Darin Newsom Analysis, said that he is neutral on gold as it looks like the price is waiting for "something to happen." He added that he sees signs that the gold market is paying close attention to geopolitical uncertainty in Eastern Europe.

"The market is watching the global political situation. Gold is waiting to see what Russia will do with Ukraine," he said.

He said that he sees gold prices trading between $1,833 and $1,781 an ounce in the current global standoff.

By Neils Christensen

For Kitco News

Time to buy Gold and Silver on the dips

David