Gold spikes to record high, backs off sharply; bulls now exhausted

Gold and silver prices sharply lower in midday U.S. trading Monday, after gold overnight spiked to a new record high of $2,152.30, basis February Comex futures. Silver hit a seven-month high overnight. The two precious metals markets are seeing the shorter-term futures traders taking profits after the recent solid gains. Importantly, today's price action in gold and silver suggests the bulls are now near-term exhausted and that near-term (but not longer-term) market tops are in place. By this I mean that gold and silver prices have probably peaked for at least a few weeks, it not a while longer, but after that new highs are probable—likely sometime in 2024. February gold was last down $44.10 at $2,046.00. March silver was last down $0.997 at $24.875.

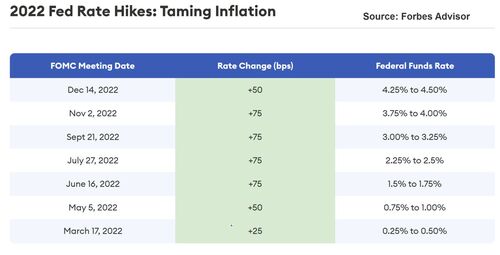

Daily bearish elements for the gold and silver markets to start the trading week are solid gains in the U.S. dollar index, rising U.S. Treasury yields and weaker crude oil prices. However, both metals remain supported by still-overall-bullish technical charts, a generally depreciating U.S. dollar on the foreign exchange market, generally falling bond yields, ongoing safe-haven demand, and notions the major central banks of the world will back off on their interest-rate-increase cycles. A serious escalation in the Middle East turmoil would likely push gold and silver prices higher and in more rapid fashion.

Asian and European stock markets were mixed to firmer in overnight trading. U.S. stock indexes are lower near midday. Risk aversion is keener to start the trading week as tensions in the Middle East are on the rise. Missiles fired by Yemen's Houthi rebels struck three commercial ships Sunday in the Red Sea, while a U.S. warship shot down three drones in self-defense, the U.S. military said. The Iranian-backed Houthis claimed two of the attacks. Meantime, Israel has resumed its military offensive in the Gaza strip.

Is Argentina's new anti-central bank stance triggering a new trend? – Cory Klippsten

Is Argentina's new anti-central bank stance triggering a new trend? – Cory Klippsten

The key outside markets today see the U.S. dollar index solidly higher. Nymex crude oil prices are weaker and trading around $73.50 a barrel. The yield on the benchmark U.S. Treasury 10-year note is presently fetching 4.448%.

Technically, February gold futures prices scored a record high of $2,152.30 overnight and then promptly reversed course to sell off sharply and score a technically bearish "key reversal" down on the daily bar chart. That's one chart clue the bulls are out of gas and that a near-term market top is in place. The bulls so still have the overall near-term technical advantage. Prices are in a two-month-old uptrend on the daily bar chart. Bulls' next upside price objective is to produce a close above solid resistance at today's record high of $2,152.30. Bears' next near-term downside price objective is pushing futures prices below solid technical support at $2,000.00. First resistance is seen at $2,075.00 and then at last week's high of $2,095.70. First support is seen at $2,030.00 and then at $2,015.00. Wyckoff's Market Rating: 7.5

March silver futures prices scored a big and bearish "outside day" down on the daily bar chart today. The bulls appear to have run out of gas. The silver bulls do still have the overall near-term technical advantage. Prices are in a two-month-old uptrend on the daily bar chart. Silver bulls' next upside price objective is closing prices above solid technical resistance at today's high of $26.34. The next downside price objective for the bears is closing prices below solid support at $23.50. First resistance is seen at $25.50 and then at $25.775. Next support is seen at $24.50 and then at $24.25. Wyckoff's Market Rating: 6.5.

March N.Y. copper closed down 935 points at 383.80 cents today. Prices closed near the session low today. Prices Friday hit a four-month high. The copper bulls have the overall near-term technical advantage but appear exhausted now. Prices are in a six-week-old uptrend on the daily bar chart. Copper bulls' next upside price objective is pushing and closing prices above solid technical resistance at the August high of 404.45 cents. The next downside price objective for the bears is closing prices below solid technical support at the November low of 362.60 cents. First resistance is seen at 390.00 cents and then at last week's high of 393.30 cents. First support is seen at last week's low of 378.60 cents and then at 375.80 cents. Wyckoff's Market Rating: 6.0.

Try out my "Markets Front Burner" email report. My next one is due out today and is going to be entitled, "When China sneezes…" Front Burner is my best writing and analysis, I think, because I get to look ahead at the marketplace and do some market price forecasting. And it's free! Sign up to my new, free weekly Markets Front Burner newsletter, at https://www.kitco.com/services/markets-front-burner.html .

By

Jim Wyckoff

For Kitco News

David

.jpg)