'Confused' Wall Street split on near-term gold-price direction

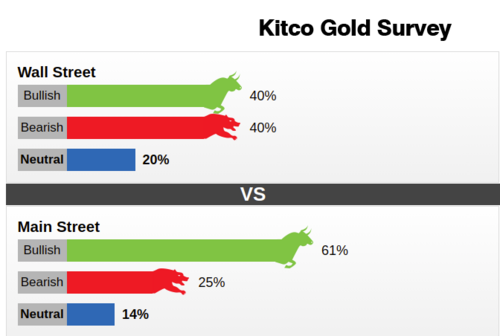

Some might argue that gold prices have been unpredictable lately, thus maybe it seems fitting that Wall Street analysts are split on price direction for next week, based on the weekly Kitco Gold price survey.

Main Street, however, remains bullish.

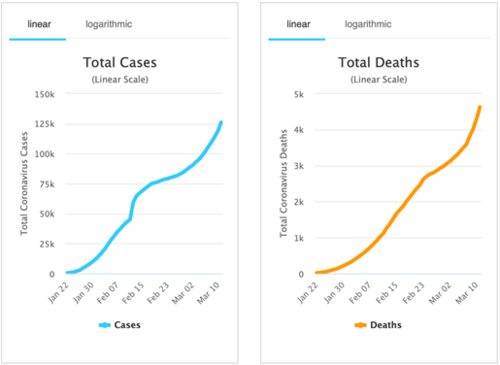

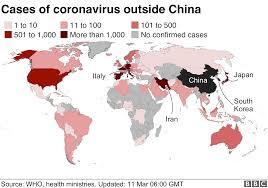

Since coronavirus became a household word in 2020 as the illness spread around the world, equities have been mostly on the defensive on worries about the impact on the global economy. At times, gold has benefited from stock-market weakness, getting a safe-haven bid. But at other times when stocks were getting hammered, analysts said some traders were having to sell profitable positions in gold to help meet margin calls and offset losses in other markets.

"Gold traders are presently confused by the volatile, up-and-down price action in gold the past week," said Jim Wyckoff, senior technical analyst with Kitco, who looks for choppy, sideways trading in a "non-trending" market.

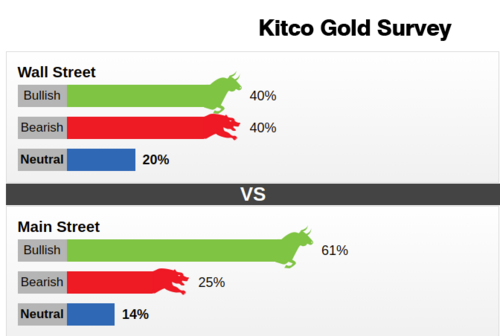

Fifteen market professionals took part in the Wall Street survey. There were six votes, or 40%, for both higher and lower prices next week. Three participants, or 20%, were neutral or called for sideways prices.

Meanwhile, 1,434 votes were cast in an online Main Street poll. A total of 873 voters, or 61%, looked for gold to rise in the next week. Another 363, or 25%, said lower, while 198, or 14%, were neutral.

In last week's survey for the trading week now winding down, Wall Street and Main Street were both heavily bullish. Needless to say, their collective prognostication missed the mark, with Comex April gold down by 5.9% for the week so far to $1,573 an ounce just before 11 a.m. EST. Still, both Main Street and Wall Street have been right more often than not so far this year. Assuming gold remains lower for the week, both will finish Friday with 6-3 records so far in 2020 for a winning percentage of 67%, based on settlements in the April futures.

Adrian Day, chairman and chief executive officer of Adrian Day Asset Management, looks for gold to bounce.

"Gold is being hit again with liquidation as the markets melt down," he said of the weaker price action this week. "In these market panics, it is a source of liquidity. But once the panic liquidation subsides, even if the broad markets do not recover, gold will resume its role as a hedge and move up."

Richard Baker, editor of the Eureka Miner's Report, looks for gold to return to the $1,620 area next week as the recent selling abates.

"The best news for gold this week was its performance relative to the embattled S&P 500," Baker said. "Gold has recovered all the value lost to this equity benchmark since the 2018 presidential election…and more. Even while dropping below $1,600, the gold-to-S&P 500 ratio (AUSP) spiked to levels not seen since late 2016. From October 2018, the AUSP has been on an uptrend of higher lows; gold has doggedly gained value on equities. This is a bullish sign going forward, leaving the path clear for the $1,800 level in 2019."

Further, Baker added, negative real rates continue to mean a "very bullish environment for a non-interest-earning asset like gold."

Peter Hug, global director of metals trading with Kitco, said he looks for gold to end higher after next week's meeting the Federal Open Market Committee. Policymakers are expected to deliver another rate cut on top of the 50-basis-point emergency cut early this month.

Meanwhile, Daniel Pavilonis, senior commodities broker with RJO Futures, looks for further near-term weakness in gold before the metal bounces.

"With the dollar popping [higher] and stocks popping, we may come off a little bit lower in gold," he said.

Equities may bounce next week as the Federal Reserve acts to try to control the economic impact of the coronavirus, with gold slipping, Pavilonis said. But then, he continued, equities may turn lower again, with gold moving higher.

"I think we may stay down nest week," said Phil Flynn, citing the potential for more liquidation, "as well as the rising possibility of gold sales from global central banks to raise liquidity to attack the coronavirus. Russia, a big holder of gold, may use that as a backstop to ride out its oil price war with Saudi Arabia."

Chimed in Mark Leibovit, publisher of VR Metals/Resource Letter: "I warned of a cyclical peak, which is typically common this time of year. Gold is overvalued over $1,445. Can it go there? Depends if the financial crisis underway forces more liquidation in the gold market."

Andrew Hecht, a precious metals contributor to Seeking Alpha, said he expects "wild conditions" with gold "up and down."

"Risk-off in 2008 gold dropped from over $1,030 to $681, and then [gold] rose to a record high in 2011," he pointed out. "Central-bank policy is ultimately bullish."

By Allen Sykora

For Kitco News

David