Bitcoin price analysis – BTC/USD rangebound under $6,400, but further losses are limited

-

BTC/USD stays below critical support, but the downside momentum is fading away.

-

New Tether coins hit the market, BTC did not react.

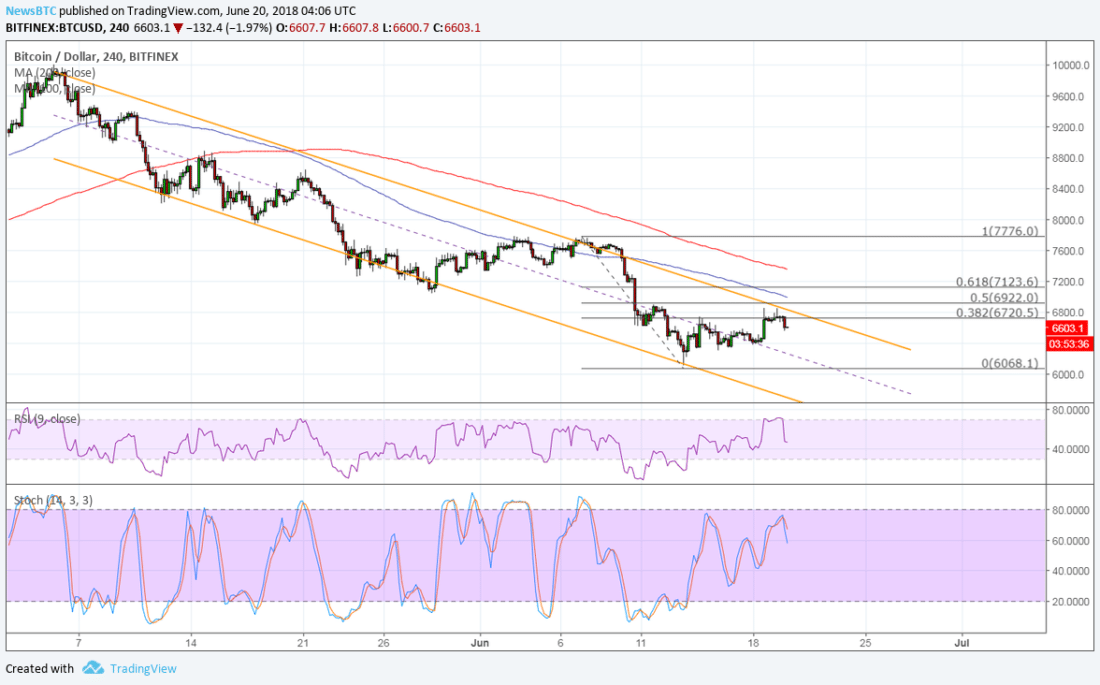

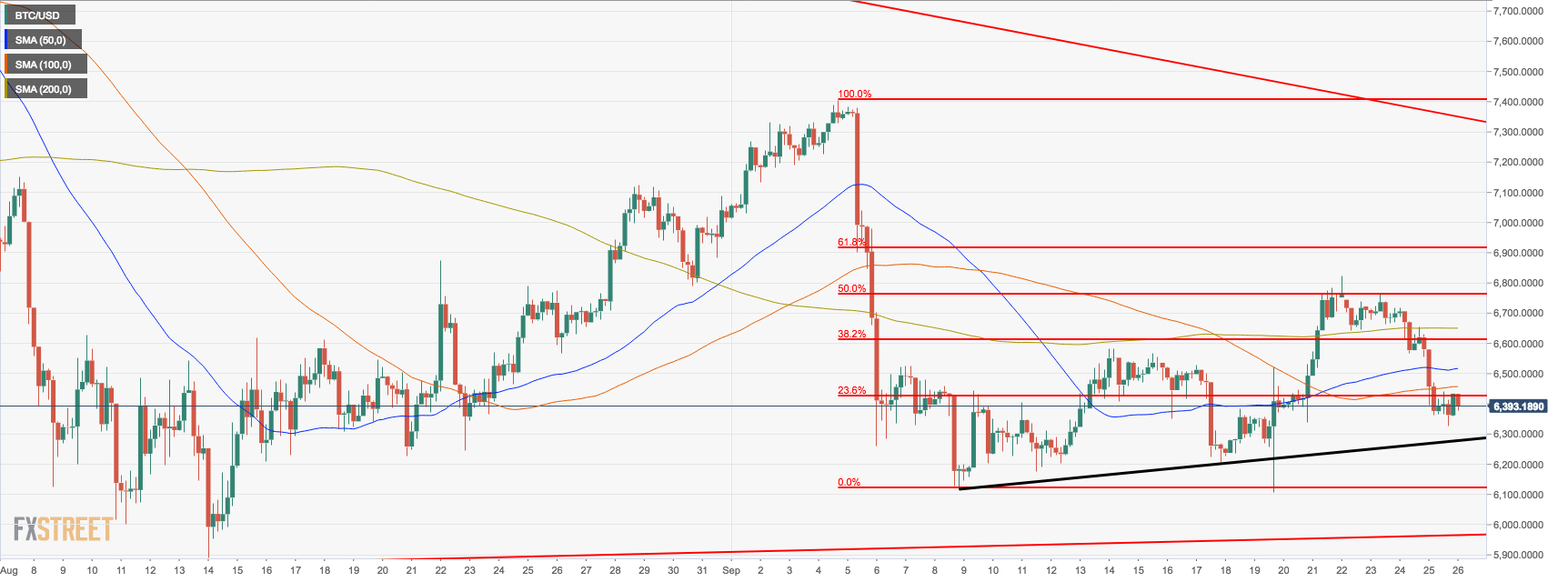

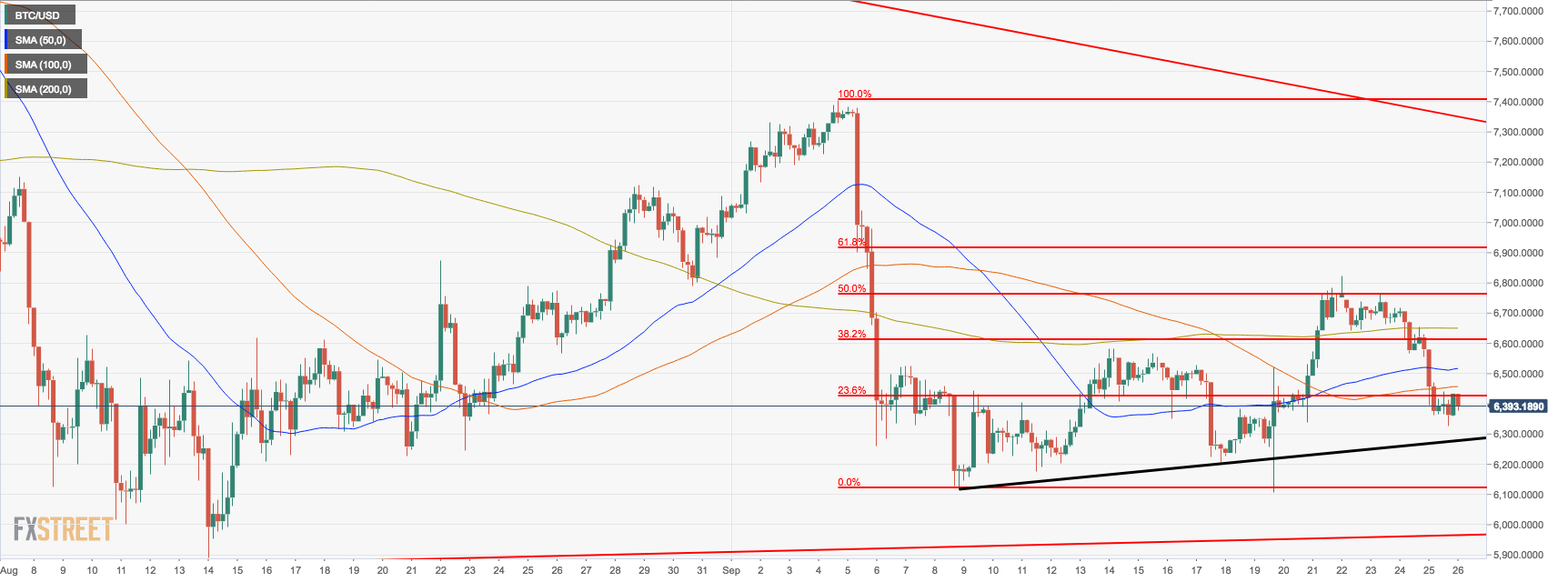

BTC/USD is changing hands at $6,388, consolidating losses incurred at the beginning of the week. The digital currency No. 1 touched $6,327 low on Tuesday, though the bearish momentum has faded away, allowing for the recovery towards the key resistance area, created by 23.6% Fibo retracement for the downside movement from September 4 peak.

Bitcoin's technical picture

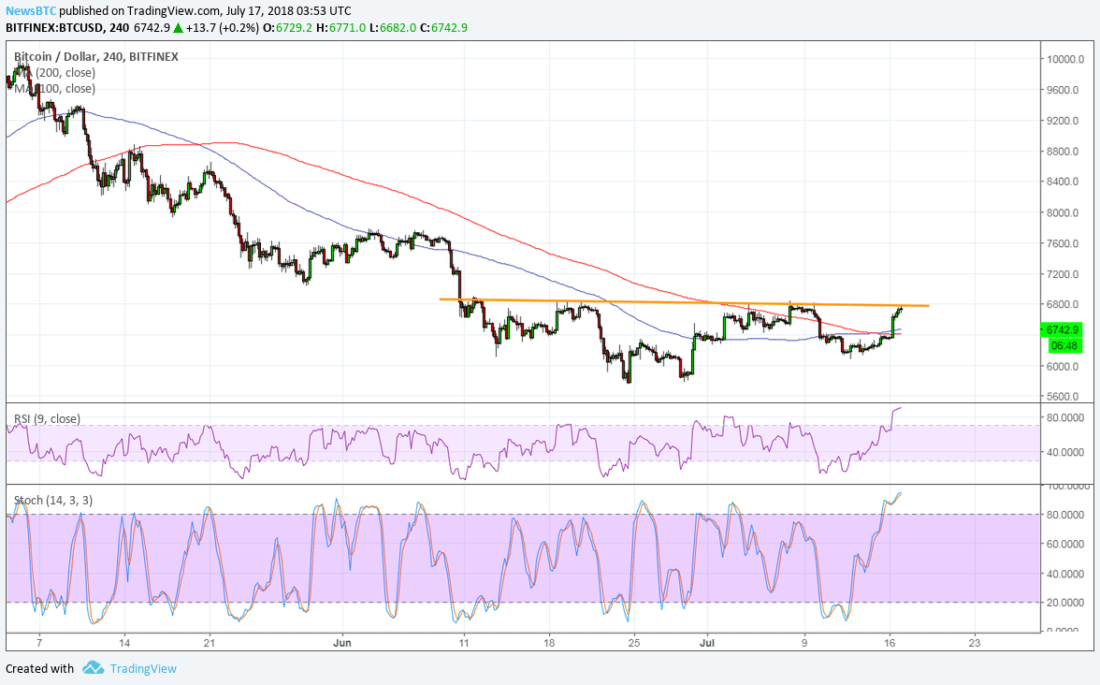

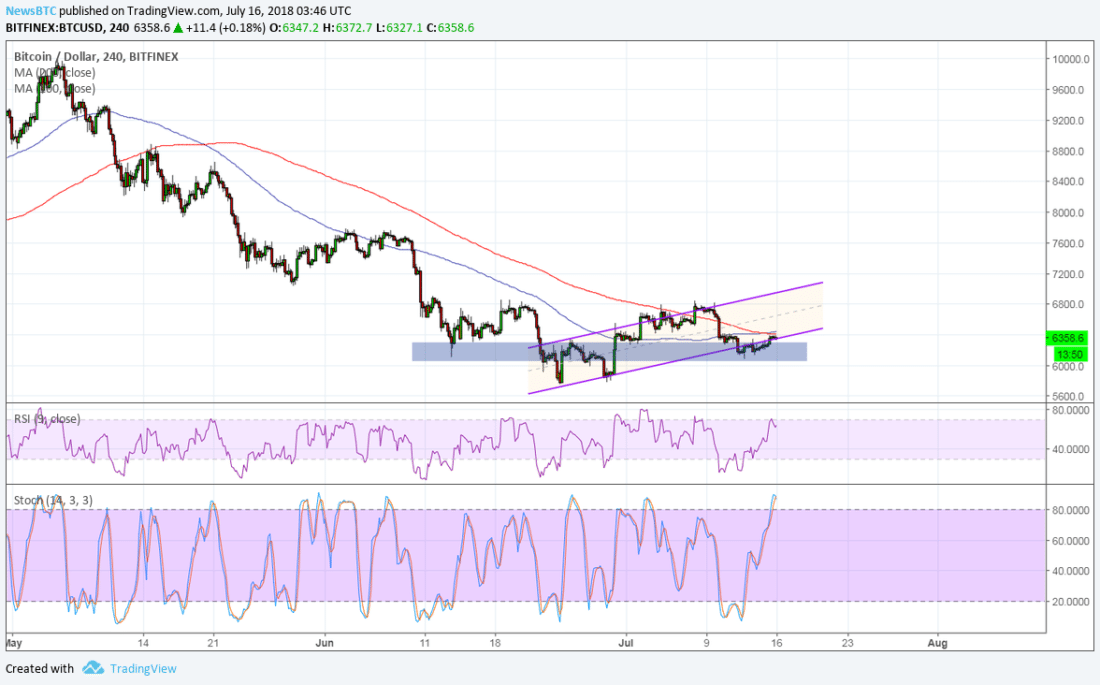

Looking technically, BTC/USD is recovering slowly from September 8 low reached at $6,114. This trend remains untouched as long as the price stays above the upside trendline currently at $6,280. Once it is broken, $6,000 will come into focus, threatening to push BTC/USD back on the bearish track.

Meanwhile, from the short-term point of view, a sustainable move below $6,400 looks nasty. If this ground is not regained soon, the selling pressure may intensify and push the price towards the above-said critical trend line support.

The next hurdle is created by SMA40 (4-hour chart) above $6,500 and $6,600 (38.2% Fibo retracement). A sustainable movement higher will allow proceeding towards $6,650 (SMA200, 4-hour chart) and psychological $6,700.

Tether movements

Meanwhile, crypto community noticed that the amount of Tether in circulation increased by $12.89M. The newly minted coins were transferred to Bitfinex, the fourth largest cryptocurrency exchange by trading volumes. However, this Tether issuance did not influence Bitcoin's momentum in any noticeable way.

Tanya Abrosimova

FXStreet

David