Gold up a bit on still-friendly charts

Kitco News

The Leading News Source in Precious Metals

Kitco NEWS has a diverse team of journalists reporting on the economy, stock markets, commodities, cryptocurrencies, mining and metals with accuracy and objectivity. Our goal is to help people make informed market decisions through in-depth reporting, daily market roundups, interviews with prominent industry figures, comprehensive coverage (often exclusive) of important industry events and analyses of market-affecting developments.

Gold up a bit on still-friendly charts teaser image

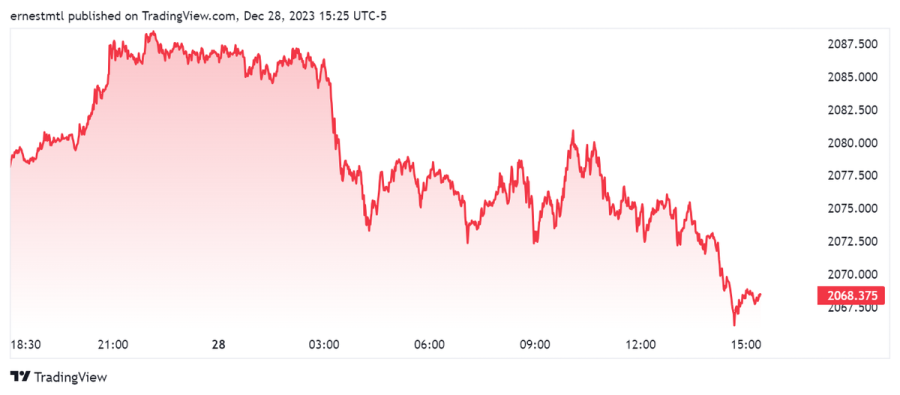

(Gold prices are a bit higher and silver a bit weaker in midday U.S. trading Tuesday. Technical-based buying is featured in gold as the charts still firmly favor the bulls. Higher crude oil prices are also bullish for the metals today. However, gains in the metals are being limited by a firmer U.S. dollar index and a slight up-tick in U.S. Treasury yields on this day. February gold was last up $3.50 at $2,036.90. March silver was last down $0.12 at $23.19.

U.S. stock index futures are mixed at midday.

In overnight news, reports said China’s central bank has indicated it may lower its reserve requirement ratio to boost lending and support economic growth, the head of the central bank’s monetary policy department told a local news agency. The PBOC official’s remark does not suggest an imminent cut but may indicate such action is on the table in the coming months, Bloomberg reported. Similar comments were made last July before the central bank reduced the reserve requirement ratio for major banks in September of last year. The metals markets may also be getting some support from this news, which could promote better consumer and commercial demand for metals from China in the coming months.

The U.S. data points of the week will be the December consumer price index report on Thursday and the December producer price index report on Friday. U.S. inflation has cooled in recent months, which has allowed the Federal Reserve to back off on its tighter monetary policy. The CPI report is seen up 3.3%, year-on-year versus a rise of 3.1% in the November report.

The key outside markets today see the U.S. dollar index moderately higher. Nymex crude oil prices are solidly higher and trading around $72.75 a barrel. Meantime, the yield on the benchmark U.S. Treasury 10-year note is presently fetching 4.011%.

Technically, February gold futures bulls have the overall near-term technical advantage. Prices are in a three-month-old uptrend on the daily bar chart. Bulls’ next upside price objective is to produce a close above solid resistance at $2,100.00. Bears' next near-term downside price objective is pushing futures prices below solid technical support at $2,000.00. First resistance is seen at this week’s high of $2,053.30 and then at last Friday’s high of $2,071.10. First support is seen at this week’s low of $2,022.70 and then at $2,015.00. Wyckoff's Market Rating: 6.5.

March silver futures bears have the overall near-term technical advantage. A five-week-old downtrend is in place on the daily bar chart. Silver bulls' next upside price objective is closing prices above solid technical resistance at $25.00. The next downside price objective for the bears is closing prices below solid support at the November low of $22.26. First resistance is seen at today’s high of $23.565 and then at $23.715. Next support is seen $23.00 and then at the December low of $22.785. Wyckoff's Market Rating: 4.0.

March N.Y. copper closed down 320 points at 377.80 cents today. Prices closed nearer the session low today and hit a three-week low. Prices also scored a bearish “outside day” down on the daily bar chart. The copper bulls have lost their slight overall near-term technical advantage. A choppy, 2.5-month-old uptrend on the daily bar chart has been negated. Copper bulls' next upside price objective is pushing and closing prices above solid technical resistance at the December high of 397.40 cents. The next downside price objective for the bears is closing prices below solid technical support at 365.00 cents. First resistance is seen at today’s high of 384.05 cents and then at 386.60 cents. First support is seen at today’s low of 377.40 cents and then at 372.90 cents. Wyckoff's Market Rating: 5.0.

Try out my “Markets Front Burner” email report. My next one is due out today and is going to be entitled, “When China sneezes…” Front Burner is my best writing and analysis, I think, because I get to look ahead at the marketplace and do some market price forecasting. And it’s free! Sign up tomy new, free weekly Markets Front Burner newsletter, at https://www.kitco.com/services/markets-front-burner.html .

Kitco Media

Jim Wyckoff

David

.png)

.png)